What happens when an active full-time employee turns age 65 and becomes eligible for Medicare? Do they have to enroll right away, or can they stay on the group plan? What happens to their HSA account? We get these questions all the time. We are not Medicare experts, so we turn to the experts at Medicare.gov to get answers from their Medicare and You Handbook 2022. One thing we do know is that once on Medicare you are no longer eligible to contribute to a Health Savings Account. But, of course, it’s a bit more complicated than that. This article is meant to guide employees when the two collide. We’ll start with the basics of Medicare eligibility and enrollment and work up from there.

Medicare Enrollment

Not everyone who becomes eligible for Medicare is automatically enrolled. Auto enrollment is determined by whether or not an employee is already receiving Social Security benefits. So, will an employee be automatically enrolled in Medicare Part A?

-

- Yes, if they already getting Social Security benefits.

- No, if they are not receiving Social Security benefits. They will need to sign up for it. Two Medicare brokers told me that it’s recommended that a letter be sent to the Social Security Administration waiving Part A to document the decision.

How do they sign up for Medicare?

There are two time periods an eligible employee can sign up for Medicare that won’t trigger a late penalty. The Initial Enrollment Period and the Special Enrollment Period.

Initial Enrollment Period:

They can first sign up for Part A (and/or Part B) during the 7-month period that begins 3 months before the month they turn 65. This includes the month they turn 65 and ends 3 months after the month they turn 65. Part A is always effective the first of their birthday month (or the month before if their birthday falls on the first day of the month). Part B will be effective the first of the following month after they sign up.

Special Enrollment Period:

To answer our earlier question about whether an employee can stay on their group plan when they become Medicare eligible, the answer is generally yes. If they elect to stay on their group plan, and not enroll during their Initial Enrollment Period, they may have a chance to sign up for Medicare during a Special Enrollment Period. For example, if they didn’t sign up for Parts A or B when they were first eligible because they were enrolled in a group plan (either theirs or their spouse’s group medical plan), they can sign up for Part A and/or Part B:

-

- Anytime they’re still covered by the group health plan

- During the 8-month period that begins the month after the employment ends or the coverage ends, whichever happens first.

Usually, they won’t have to pay a late enrollment penalty if they sign up during a Special Enrollment Period.

If they don’t sign up during their Initial Enrollment Period, and they don’t qualify for a Special Enrollment Period, they can sign up during the next General Enrollment Period (every January 1 – March 31).

It’s important to note that when they finally do enroll in Part A coverage, if not during the Initial Enrollment Period, their Medicare coverage will take effect retroactively six months from when they apply for it. This is important because it impacts their HSA eligibility. We’ll talk more about that later in the article.

General Enrollment Period

As mentioned, the General Enrollment Period is from January 1st through March 31st each year. They may have to pay a higher Part A and/or Part B premium for late enrollment.

Part A coverage is free if they worked and paid into Medicare for a certain amount of time. If they don’t meet those criteria, they can pay for Part A.

Is there a Part A late enrollment penalty?

If they aren’t eligible for premium-free Part A, and they don’t buy it when they’re first eligible, their monthly premium may go up 10%. They’ll have to pay the higher premium for twice the number of years they could have had Part A but didn’t sign up. For example, if they were eligible for Part A for two years but didn’t sign up, they’ll have to pay a 10% higher premium for 4 years.

What is the Part B late enrollment penalty?

For this article, our audience is typically a full-time employee interested in keeping group coverage and keeping HSA eligibility. They have delayed signing up for Part A and B because they are currently enrolled in a group medical plan (either theirs or their spouses). When they retire, they qualify to sign up for Part A and B under the Special Enrollment Period during the 8-month period that begins the month after the employment ends or the coverage ends, whichever happens first. In this case, there is no penalty for enrolling during this Special Enrollment Period.

For those who are not enrolled in a group medical plan when reaching age 65, if they don’t sign up for Part B when first eligible, during the first 3 months of their Initial Enrollment Period, they may have to pay a late enrollment penalty for as long as they have Part B. The monthly Part B premium may go up 10% for each full 12 months in the period that they could’ve had Part B but didn’t sign up. Ouch.

What happens to an HSA Account when an employee becomes eligible for Medicare?

The answer to this question depends on when they enroll in Medicare.

-

- Regardless of whether they are still working, if they start receiving Social Security benefits, they are no longer able to make contributions to their HSA bank account after they signed up for Medicare. They must make their last contribution the month before their Medicare Part A coverage begins.

- However, if they are working a full-time schedule and are not receiving Social Security benefits, they will not be automatically enrolled in Medicare Part A. Assuming they do not take action to enroll in Part A, when they do retire, Part A coverage will go back retroactively six months from when they enroll. They cannot make HSA contributions while they are on Medicare, so to avoid a tax penalty, they need to cease HSA contributions six months before they apply for Part A.

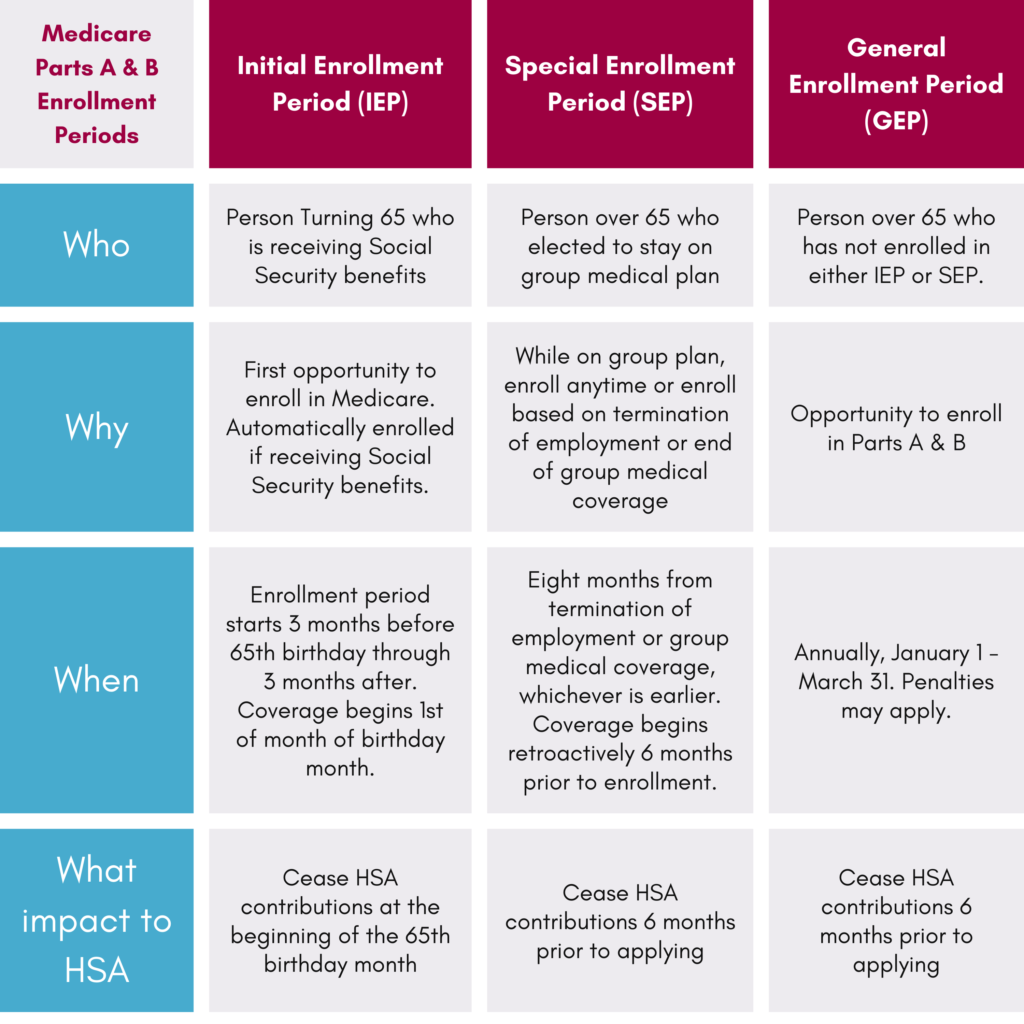

There’s a good deal of planning and organization around Medicare enrollment. As with most federal programs, it is not straightforward. We’ve put this chart together to help employees map out a timeline.

This article is long overdue. Because of the complexity, we’ve been hesitant to advise employers or employees when it comes to turning age 65 and HSA eligibility. This article quotes the Medicare & You Handbook nearly verbatim, so guidance came from the experts, which we are not. I hope you and your employees find it useful.

The information presented above is based on consultations we had with Medicare specialists and Medicare.gov. This information is intended as a guide and we encourage everyone to seek assistance from a Medicare expert regarding your own personal situation.