Here’s the situation. An employee gets injured on the job and files a Labor & Industries (L&I) claim. Do you keep him on benefits? You might be inclined to ask the L&I Claims Manager, but they are not COBRA experts able to answer this question. Apparently, there’s some reported misinformation out there, so before you continue coverage, make sure you read this article first.

The mystery and misinformation has stemmed from clients telling us that they have been told by L&I Claim Managers to keep the injured employee on Active employee benefits for an indefinite length of time. One broker said an injured employee had been kept on benefits for 2 years because of the confusion. So, let’s clear something up.

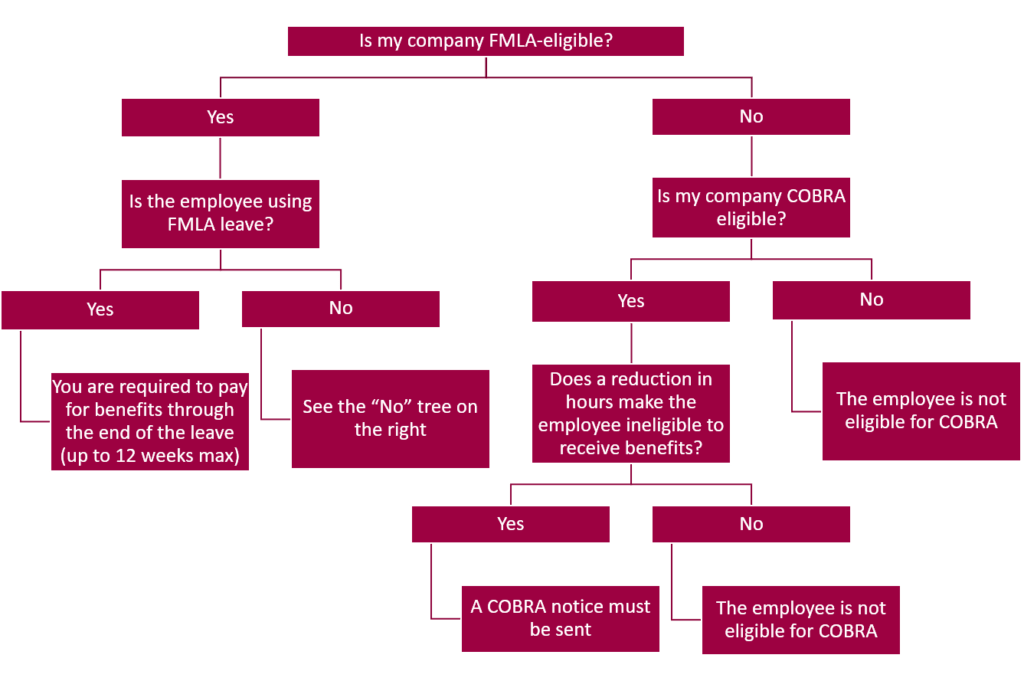

The only instance where you are required to keep an injured employee on employer-paid benefits is if the employer is required to comply with FMLA and where the employee has elected a properly documented FMLA Leave. In this case, once the employee’s FMLA leave has expired, you are no longer required to cover this employee.

This was confirmed for me by a Department of Labor COBRA division specialist in Washington state. She was unaware of any State or Federal law which requires an employer to keep an employee on benefits with active status for an undetermined length of time. (Even with FMLA, you are only required to keep an employee on for the maximum 12 weeks of the leave.) In fact, my question was completely new and foreign to her.

I was bothered that we had had multiple incidents of clients telling us that they had received bad information directly from L&I, so I called them too. I spoke with a Claims Manager who told me she had never been told to advise an employer to keep a claimant on benefits. She then called L&I’s training department and confirmed they would not/could not tell an employer what to do regarding a claimant’s benefits. When a claim is filed with L&I, the Claims Manager calls the employer to ask about the claimant’s wages. The employer is then asked about employee benefits (employer’s paid portion) and what date benefits are expected to end. They do not advise you about benefits, they only inquire about benefits. The L&I Claims Manager will then add to wages the amount of employer-paid benefits to arrive at the lost wage amount.

So, unless you are an FMLA-eligible employer and your injured employee elects to use his FMLA leave to cover the absence, you are no longer required to pay for benefits.

L&I & COBRA

Now, an L&I claim that involves a reduction of hours that renders an employee ineligible for benefits should receive a COBRA notice (provided you are a COBRA-eligible employer). COBRA would start the first of the month following a reduction of hours (even if it’s zero hours worked).

In the case of an FMLA-eligible employer with an employee using formal FMLA leave (document this!) then employer-paid benefits would end at the end of the month following 12 weeks (maximum) of FMLA leave. At this time a COBRA notice will need to be sent using “Reduction of Hours” as the qualifying event and using the last day of the 12 weeks of FMLA leave as the COBRA qualifying event date. COBRA starts the first of the month following.

Never one to leave any stone unturned, I called a large FMLA-eligible employer client of mine with recent experience having an employee who filed an L&I work-related claim for a real-life reality check. Indeed, this injured employee was kept as an active employee on benefits for 12 weeks due to a properly documented FMLA leave. Then the employee was mailed a COBRA notice at the end of that 12 weeks citing “Reduction of Hours” making him ineligible for employer-paid medical insurance, but now eligible to elect COBRA.

So, back to the original question: If an employee gets injured on the job and files an L&I claim, do you keep him on benefits?

The answer is to ask a few more questions:

There really is no mystery. If you have a work-related injured employee, make sure an employee is eligible to stay on coverage before you continue to pay.

You may feel uneasy removing this employee from coverage, but remember that when a claimant seeks medical care for a work-related injury, the medical provider will submit the medical bills to L&I, not to the group medical insurance carrier. So, their bills are still going to get paid.

And finally, question any L&I Claims Manager who tells you that a non-FMLA-eligible employee needs to stay on benefits. If they push back, call me and I’ll talk to them.