Last month, I regaled you with a litany of confusion, lack of guidance, abundance of questions, disparate answers leading up to the tsunami that was the ARPA/COBRA Notice deadline of May 31, 2021.

Well, somehow we did it. I am happy to report that we mailed 2,200 ARPA Notices before the 5/31 deadline. Phew! Unfortunately, 265 of them were returned undeliverable for bad addresses so we had to email employers asking for every single bad address and resent about 1/3rd of them a second time. There are still a number of employers who have not responded to us, and a percentage of more undeliverables from our second mailing, so we’re busy documenting that we made every effort to get the darn things in the hands of participants.

Given the sheer number of Notices sent, we were expecting an onslaught of calls/questions and a flurry of new COBRA enrollees. In both those respects, the response has been surprisingly quiet. Our phones weren’t ringing off the hook with questions. We haven’t received a pile of enrollment forms. In fact, most of our busy work has been thanks to a poorly written Attestation form courtesy of the DOL (which, by the way, is the same confusing form they used in 2009 for ARRA).

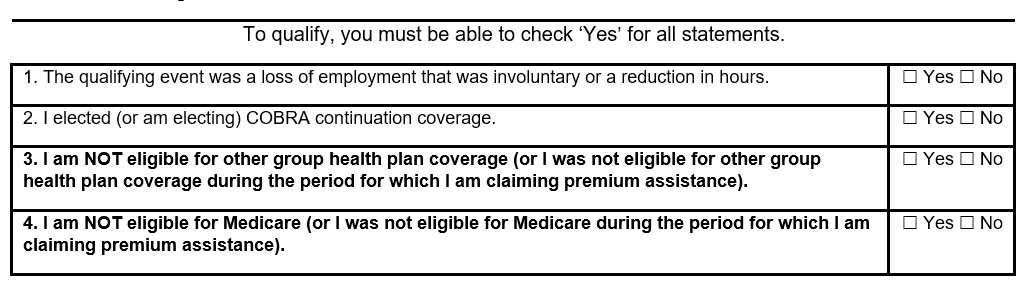

See Exhibit A, questions 3 and 4:

In my mind, the intuitive answer to questions 3 and 4, if I think I am eligible for the subsidy, would be “no.” And, clearly, given the number of forms we received with the “no” boxes check, most people think like I do. So, our time has been spent reaching out to would-be new COBRA participants and saying “did you really mean to check ‘no’ on questions 3 and 4?”

There have been, however, a couple of prevalent FAQs. The answer to one caused pushback from carriers until we researched the IRS guidance.

From the IRS FAQ:

Q-44. Must an Assistance Eligible Individual electing COBRA continuation coverage under the ARP extended election period begin coverage as of the first period of coverage beginning on or after April 1, 2021?

A-44. No. While a group health plan must make COBRA continuation coverage with COBRA premium assistance available as of the first period of coverage beginning on or after April 1, 2021, in the case of an Assistance Eligible Individual electing COBRA continuation coverage under the ARP extended election period, the Assistance Eligible Individual may waive COBRA continuation coverage for any period before electing to receive COBRA premium assistance, including retroactive periods of coverage beginning prior to April 1, 2021.

In English, the question refers to a would-be participant who did not incur any claims during April or May and wanted COBRA to begin in June rather than retroactive to 4/1. The carriers initially thought ARPA eligible individuals had to elect COBRA April 1st. The IRS FAQs came back and said “Heck yeah, you can join in June and then we don’t have to pay the carriers a subsidy for those 2 prior months!”

In line with the non-enrollment for April and May, despite my bemoaning receiving the IRS guidance letter so near the Notice deadline, there was a bright side for employers in the lateness of the guidance. Had the guidance been received earlier, employers might have been compelled to pay premiums for April and May and then wait to be reimbursed via reduced payroll tax liability. It’s a small victory, but with this whole mess, we have to take what we can get.

On the flip side, FAQ #2 is one I wish we had known the answer to back in March when we first started fielding questions. It relates to spousal eligibility.

Q-9. If a potential Assistance Eligible Individual was eligible for other group health plan coverage before April 1, 2021, but on and after April 1, 2021, has not been permitted to enroll in that other group health plan coverage, is COBRA premium assistance available for the individual’s COBRA continuation coverage?

A-9. Yes. COBRA premium assistance is available to a potential Assistance Eligible Individual until the individual is permitted to enroll in coverage under any other group health plan (including during a waiting period for any other plan).

This question addresses someone who was eligible for his/her spouse’s plan at open enrollment before 4/1/2021 but that window of time has since passed and they are no longer able to join the spouse’s plan. They can legitimately answer the attestation question to say they are not eligible for other group coverage because they were eligible before 4/1/21 but that door is closed now. I wish we had this guidance back in March and April when we were taking the highest number of phone calls about ARPA. I’m pretty sure we told folks they were not eligible for the ARPA enrollment & subsidy because they WERE eligible for other group coverage.

Beyond mailing the notices, clarifying attestations and answering previously unanswerable questions, billing for all this work was a monumental task. We billed client $6.00 per ARPA Notice since it was outside of our normal COBRA service agreement. We billed our clients the 2% COBRA fee for those who signed up for COBRA and the “government” paid the premium + 2% COBRA fee. I tell you this because it is important given how an employer is being reimbursed for the subsidy. As I said earlier, it’s through a reduction in payroll tax liability via the Form 941 reporting and the fee is part of what can be recouped.

The first round starts with the IRS 941 filings that are due in July. Employers need to tally the amount of ARPA subsidy premiums AND the 2% COBRA fees they have paid the insurance carriers and us to reduce their payroll liability for Quarter 2. Instructions for how to calculate the line items and complete the form can be found here. We expect to get more questions as employers start to tackle this form.

It’s been quite the past few months. The numbers tell the story:

-

- 2200 ARPA notices mailed

- 265 ARPA notices returned undeliverable

- 83 remailed to newer addresses

- 130 ARPA notices tossed because the employers did not have the current addresses

- 52 ARPA notices are awaiting employers searching for better addresses

- 159 SBA COBRA participants are enjoying the government paying their COBRA premiums

I’m sure this is not the end of this story. There will be unintended consequences, misinterpretations and head-scratching questions that lie ahead. It’s the nature of the beast when you’re dealing with the federal government in panic mode. Stay tuned.