You’ll recall, in April, the IRS and DOL issued new guidance with respect to COBRA deadlines during the COVID-19 outbreak, extending the time participants can make elections or pay COBRA premiums:

| Old | New |

|---|---|

| A qualified beneficiary had 60 days to elect COBRA from the loss of coverage date or the date the COBRA notice was mailed, whichever is the latter. | Anyone with a qualifying event on or after March 1, 2020 may elect COBRA at anytime until the announced end of the National Emergency or such other date announced by the Agencies in a future notice. |

| COBRA participants, once enrolled, have 30 days grace period to pay premiums. Example: May premium is due May 1st but an envelope postmarked May 30th will be accepted and considered “on time.” | COBRA participants, once enrolled, have 30 days grace period to pay premiums. If they cannot pay the premium, they cannot be terminated due to failure to pay. As of today’s date, insurance carriers are scrambling to figure out how to handle this. |

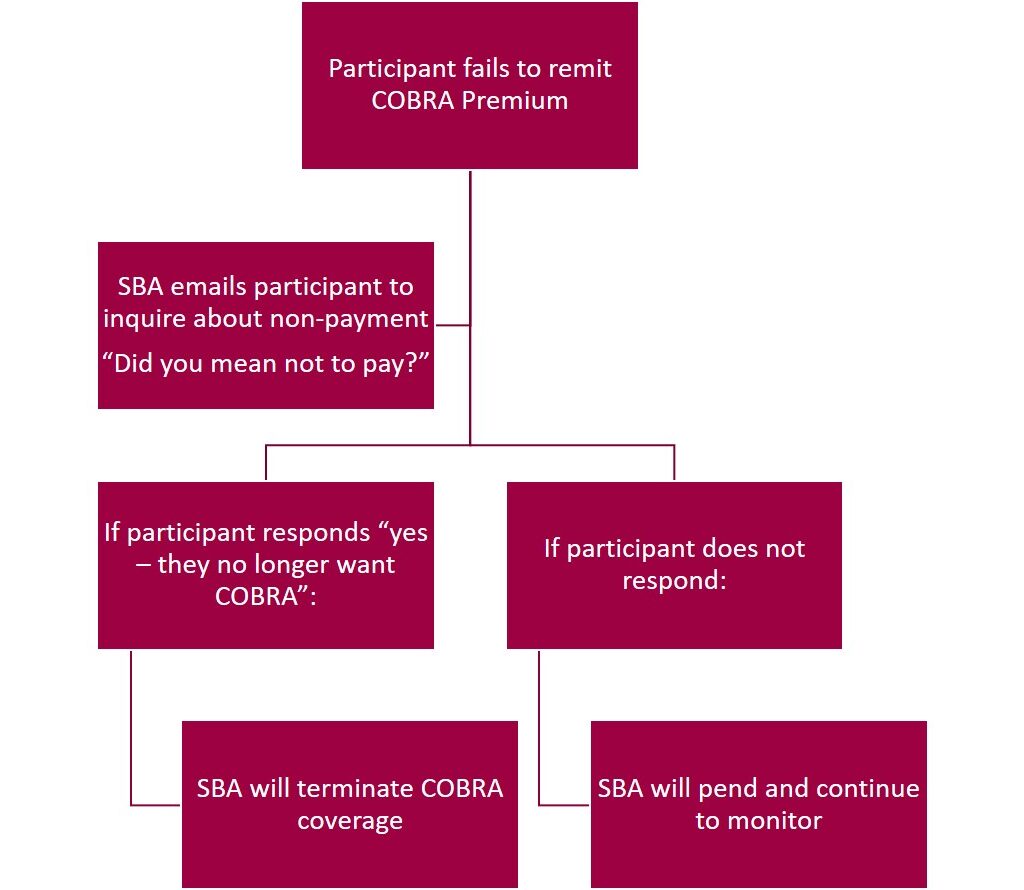

The open-endedness of this guidance left those of us responsible for managing COBRA scrambling to figure out how to quickly comply. Unsurprisingly, as you will see below, there is little consistency in how the carriers are interpreting the guidance. Therefore, we set out to save our sanity and yours by implementing the following COBRA procedures for non-payment by COBRA participants during the outbreak period:

We intend to send our check-in emails early in the month to allow participants more time to respond.

But, even knowing how we would proceed, we still had many questions on how carriers would apply the new tolling deadlines, so we presented a list of our questions to the carriers we work with and we’re sharing their responses with you. Please note we did not receive a response from all carriers – and we’re sharing this information mainly so you can get a better understanding of the controlled chaos this “guidance” has unleashed.

COBRA-COVID Procedural Questions

When should SBA notify you (carrier) that someone has failed to pay their premiums after the normal 30-day grace period?

| Regence | Same as today – no changes |

| Principal | We request our customers to submit changes within 31 days from the effective date of change. However, you can notify Principal at any time if a member has failed to pay their COBRA coverage so we can process the termination. |

| MetLife | I highly recommend notification be sent to MetLife once a COBRA participant has not remitted premium following the 30 day grace period. This will allow us to notate the group’s account for their monthly premium payment not being paid as billed. |

| Delta Dental | Due to federal mandates the grace periods have been extended. We would only need to be notified if the member decides to terminate their coverage or at the end of the mandate. |

What specifically does SBA ask you (carrier) to do? Do we ask that you put him/her in pending status? If so, do we then notify you when that person pays? If they never pay, do we need to notify you to terminate that person X months from now when the virus crisis has come to an end?

| Regence | Just let us know who has paid so we can update those who have not. Regence needs to know the paid-through date of the COBRA member in order to update their paid-through date. Routing payments when received and advising who they are for and how many months they are paying will help us apply the payments timely so we can update our records. There is no need for further action if the payment is not made by the member. Simply forward premium indicating which COBRA members it is intended for and we will take care of the rest. |

| Principal | Unfortunately, we do not place member records in to pending status as they are either “active” or “terminated.” If we receive notice that a member’s payment was received after we term the record, we are able to reinstate the member with no lapse. |

| MetLife | Currently, the 30-day grace period has been extended to 90 days for each month’s billing. For example, the April premiums would typically be due on or before May 1st. During the current situation, the April premium would need to be remitted on or before July 1st. The May premiums will need to be remitted on or before August 4th and so forth until further information is received. If a group is set up as a CAL-COBRA, each participant is billed individually so we would be able to note their record specifically. |

| Delta Dental | As we do not administer COBRA policy, this is the Group or TPAs responsibility to notify us of how the eligibility updates are processed. We will work with you on any members that were impacted by the COVID outbreak on any unpaid premiums past the retro period, after the mandate is over. |

Do we ask you (carrier) to create COBRA sub-groups for every client with a COBRA participant currently on the Active group invoice, so the employer has more time to remit payment for the COBRA participant? What if there are 3 COBRA participants and 2 have paid but one has not? Can the employer remit payment for the two on a COBRA sub-group and have the other in pending status without harming the 2 who have paid?

| Regence | This is advisable as COBRA and state continuation is on a self-pay basis. If the tolerance is not met on an active employee subgroup, the subgroup is in danger of terminating should payment not be received timely. COBRA subgroups are set up to suspend the member who has not paid vs. termination of the subgroup for non-payment. COBRA and state continuation subgroups are set up for self-pay meaning if we do not receive the funds, we suspend the person who has not paid in order to advance the paid through date of those who have. Yes, the employer can remit payment for the two on a COBRA sub-group and have the other in pending status without harming the 2 who have paid. |

| Principal | If a group is set up as Group COBRA billing, then it is the employer’s responsibility to collect/submit payment for all active members. We always suggest the group pays their monthly premiums as billed and any adjustments will reflect on the following billing statement. Therefore, if a member fails to make a payment and we are notified, we can term the record and any credits will reflect accordingly on the next statement. If the group would like to change the billing option to Individual, this will then require the members to submit their monthly premiums to Principal directly. Therefore, leaving the member responsible for their own coverages and their coverage will not lapse due to another person’s failed payment. |

| MetLife | Federal COBRA is setup under a separate class for the group. There is no need to set up a separate division for COBRA participants at this time. The group and/or COBRA vendor will want to provide the premium payment information if 2 out of the 3 COBRA participants have paid. The group or vendor should keep track of who has paid their premiums to eliminate premium payment confusions in the future. |

| Delta Dental | It is always preferred to have a separate subgroup designated for COBRA members, however this is up to the group/TPA on their preference. And yes, the employer can remit premiums for COBRA members that have made their payments without interruption to the other cobra members on that sub-location. Please provide a list of members that have paid along with your payment. |

What does SBA tell the employer? In the scenario above, we told you (carrier) we have three people who have not paid X month’s COBRA premium. Do we assume you put them in pending status and maybe move them to a COBRA sub-group? Does the employer get a credit for paying for month’s X and Y? Can they short pay the next month’s premium by three months because a COBRA participant has not paid their premiums? Because employers are struggling to keep going financially, some credit for a non-paying COBRA participant seems reasonable but is it do-able in your system? We don’t want to advise employers in a way that might jeopardize the active group because of short payment for these COBRA participants.

| Regence | COBRA and state continuation (where applicable) are on a self-pay basis. If the member is already enrolled on COBRA and doesn’t pay, we need to know the date the member is paid through so we can adjust our paid-through date in our system. Payment should be remitted for those who have paid. The groups should advise us who is being paid for and for which months when premium is submitted. If termination has not yet taken place for an employee who is listed as active, timely notification is essential. The groups need to ensure that all COBRA/Continuation members are enrolled appropriately. The bill should reflect the ‘C’ for each person who is COBRA. If one of those members has not paid their premium the group should indicate what the members paid-through date is so we can adjust the status in our system and apply the groups funds appropriately. Refer to the responses in question 3 – COBRA subgroups are advisable in order to keep the active billing separate from the COBRA members. |

| Principal | Currently, due to COVID-19, all groups have a 60-day grace period in order to submit payments without going in to lapse status. If accommodations are needed beyond this, we ask the groups to call us at 800-843-1371 to discuss other options. Otherwise, they can also reach out to their account executive. |

| MetLife | COBRA participants should already be enrolled in a specific class and or division for their COBRA election. If a COBRA participant has not remitted their premiums, the group can remit payment less than the billed amount at that time. However, the COBRA participant is required to remit premiums within 90 days to prevent termination due to non-payment of premiums. Again, if the group notifies us why the premiums were not remitted in full, we can note the account accordingly. |

| Delta Dental | It is highly recommended that a COBRA subgroup is created, this way the delinquent premiums do not impact the active/main groups invoicing. Until further notice we will not be terminating COBRA records due to unpaid premiums during these pre-established timeframes. |

Does your head hurt? We reached out to another TPA in our network. They responded, “We’re also having a hard time understanding the logistics of the extensions, especially with payments. It’s really nice to help out our clients but it’s creating so many questions and uncertainty!” I guess it’s good to know we’re not alone.

We have put our internal procedures in place with respect to those participants in premium arrears and will continue to work with individual carriers to satisfy their payment remittance policies. The general response from all the carriers appears to be that they recognize there will need to be leeway and adjustments made.

I guess the bottom line is to line you know, we got this…as best as we can.