Flexible Spending Account (FSA)

How an FSA works

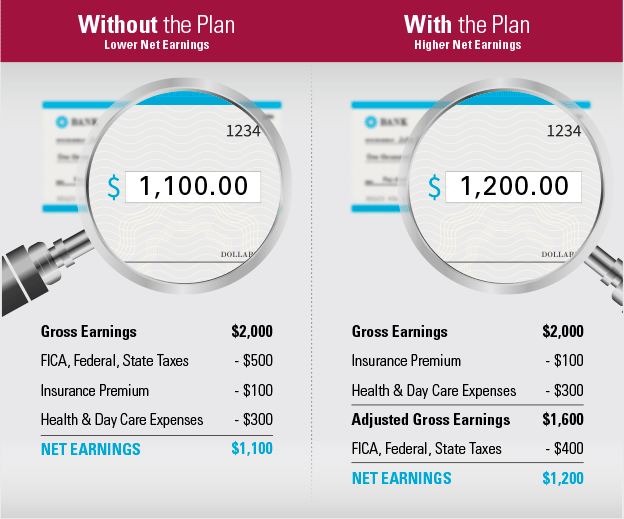

Say you make $2,000 each month and decide to participate in your employer’s Flexible Spending Account plan. Your out-of-pocket insurance premiums, as well as eligible health and daycare expenses, are paid using tax-free dollars. This creates an additional $100 dollars extra in your pocket each month!

What is an FSA?

Sometimes referred to as a cafeteria plan, flex plan, or a Section 125 plan, a Flexible Spending Account lets you fund an account with pre-tax dollars. During the year, you have access to this account to help pay for eligible out-of-pocket medical, dependent daycare or transportation expenses.

How does it benefit me?

- You decide how much to contribute to the plan each year based on you and your family’s needs for covered expenses up to an IRS-set maximum.

- Your contributions to the plan are made automatically through payroll deduction.

- Because you use tax-free dollars to pay these expenses, you increase your spending power and realize substantial tax savings.

- You can receive reimbursement for your entire claim, up to the amount you elected to contribute for the plan year, regardless of what’s been deducted from your pay to date

- You can file a claim as often as you want. No waiting until the end of the year.

What else do I need to know?

Unless your employer’s plan has a carry-over provision, the plan is use-it-or-lose it. If you don’t spend all the money in your account by the end of the year, you will forfeit the balance. Plan wisely.

Once you have decided the amount to contribute to the plan, it is set for the rest of the plan year, unless you have a change status, like getting married, having a baby, or an employment change. Again, plan wisely.

- Proper documentation, like an Explanation of Benefits statement from your insurance company or receipt for over-the-counter medications, must accompany your claim form.

Frequently Asked Questions

How do I get reimbursed for my FSA expenses?

Once you have completed the Flexible Spending Account Enrollment Form, you will receive a claim form and instructions on how to file a claim. Simply complete the form, attach a copy of the itemized healthcare or dependent care statement and send it to Sound Benefit Administration via fax, email, or mail. You may also complete an online claim form (logging into the SBA website is required for this) and upload your claim backup securely.

What if I don’t use all of the money in my FSA account(s) by the end of the plan year?

You may forfeit any funds left in your account if you do not submit eligible expenses prior to the end of the plan’s run-out period (60 days after the end of the plan year).

NOTE: Some employers have adopted an option to help you spend down your remaining balance at the end of the year ($500 Carry-Over or 2.5 Month Extended Grace Period options). These options come at a risk to the employer. Please check with your employer to see if your plan has adopted one of these options.

What do I need to do if I terminate employment and I’m an FSA participant?

You have 60 days after your last day at work to submit claims incurred during the plan year up to your last day worked. After 60 days your run-out period has ended unless you work for a COBRA eligible employer and have elected the FSA as a COBRA benefit. NOTE: The 2.5 month extension or $500 carry-over balance does not apply if you terminated employment.

If I am not covered under my company’s health insurance plan(s) can I still contribute to an FSA?

Good News! If you are eligible for your employer’s group healthcare plans but waive enrolling in them, then you and your family (legal dependents) can still participate in the Healthcare, Dependent Daycare, or Transit FSA Accounts.

Can Sound Benefit Administration pay a provider directly?

No. You pay providers directly and are reimbursed for those eligible expenses.

Will a credit card receipt substantiate my FSA claim?

No. Do not submit copies of cancelled checks, credit card receipts or debit card receipts. This does not meet the IRS requirement of having the date of service, description of service, and patient responsibility. An EOB or Itemized Patient Statement shows all of this required information.

My doctor and dentist cancelled my appointments due to the COVID-19 outbreak. Can I lower my Health FSA election during this pandemic?

On May 12, 2020, the IRS issued guidelines allowing employers to amend their FSA plans to permit changes to annual elections or allow new elections. Refunds of previously contributed contributions are not permitted. Check with your employer to see if your plan to allows for mid-year changes to your healthcare FSA. If allowed, you will need to complete a change of status form.

Keep in mind that even if you had an elective procedure planned and/or a doctor’s appointment scheduled, we are hopeful that you will be able to use your full election prior to the end of the plan year. You might also consider other procedures/services/products that could utilize un-used funds. Remember, the CARES Act now allows for OTC medications to be eligible for reimbursement without a prescription – but be careful not to stockpile.

Please note that if you are an HSA participant, you can increase, decrease or cease your contribution at any time.

Can I take both the dependent care tax credit on my tax return AND use the FSA account to pay for my dependent care expenses?

No. Whether or not to participate in the daycare portion of this plan depends on your income, filing status, number of dependents and annual daycare expenses. Contact Sound Benefit Administration at (360) 779-7047 to assist you in determining whether participation in this plan or taking the dependent care credit on your tax return will give you greater tax savings. You cannot do both because it is considered “double-dipping.”

Can I only claim the amount up to what has been deposited into my FSA Healthcare Account?

No, you are eligible to receive reimbursement for your entire patient responsibility up to your plan year election regardless of what’s been deducted from your pay to date.

If I set aside part of my pay for an FSA or HSA, won’t I make less money?

No. Your net take-home pay will increase by the amount of taxes you did not pay.

Can the cost for orthodontia treatment that lasts longer than the current plan year be reimbursed by the FSA up-front?

Yes. Submit a claim form requesting your out-of-pocket expenses along with a copy of the orthodontia contract and we will reimburse the total amount of the treatment up-front up to your annual election, less previous reimbursements. You will no longer have to submit a Claim Form each month as services are rendered for reimbursement.

I’m worried about the COVID-19 pandemic. Can I buy disposable face masks as an eligible expense through my HSA or FSA?

Yes, when purchased because there is a current respiratory epidemic or you have a family member who is sick with a communicable illness, a disposable mask is eligible for reimbursement from your HSA or FSA.

What do I need to do if my claim is denied?

Ineligible or duplicate claims need not be resubmitted. Some denied claims for reimbursement require more information. A new claim form must be completed with the additional documentation being requested.

Do I have to pay the orthodontia charge in full before it can be reimbursed to me through the FSA?

No. It is not necessary to pay the entire amount up-front in order to be reimbursed for the total contracted amount. Remember, we can only reimburse you for the total cost up to your annual election, less previous reimbursements. Read more here.

How long will it take for my FSA claim to be processed?

Claims received between Monday and Friday are processed during that week received. The following Tuesday we will notify your employer that you need to be reimbursed and the amount (never details about your claim). Check with your employer to find out what their reimbursement method is because each employer may reimburse participants differently.

How often can I file claims on my FSA Healthcare Account?

As often or as seldom as you choose throughout the plan year.

What paperwork do I need to submit an FSA daycare claim?

We have two daycare claim forms for you to use. The first is when you use a licensed provider who supplies monthly invoices for daycare services. The monthly invoice should include the contact information and the Federal Tax ID number of that provider. The second form is for non-licensed providers who do not provide a monthly invoice. Complete this form and request the signature of the daycare provider. No additional receipt is necessary when you use this form. Remember, it is not necessary that you pay your daycare provider before you submit a daycare claim. Both claim forms are available in the forms library.

What expenses are considered eligible for HSA or FSA reimbursement?

You can use a HSA/FSA to pay for many medical, dental and vision expenses tax-free. Click here to see what expenses are eligible.

Do I need to show proof of payment to get reimbursed for an FSA claim?

No. You do not need to show proof of payment. You only have to show you have incurred the expense. In some cases proof of payment may help substantiate patient responsibility.

Who is a legal dependent?

A legal dependent is classified as your spouse, your child(ren), your adopted child(ren), or anyone else you are legally responsible for. For federally-regulated IRS employee benefit plans incurred by domestic partners and/or their children (not your biological children) are not eligible for reimbursement under this plan. You may not submit charges incurred by anyone other than yourself, your spouse, or your children, otherwise known as your legal dependents.

Do I need to mail original receipts for my FSA claim?

No. If you fax photocopied claims to us you do not need to mail originals. Additionally, if you mail your claims instead of faxing them, PLEASE keep original receipts for your records and mail us photocopies. We do not want the responsibility of storing your originals.

Why should I participate in the Flexible Spending Healthcare Account when I already have medical, dental, and/or vision insurance?

This account is used to pay for expenses not covered by insurance (click here for a list of possible eligible expenses). For example:

- Deductibles, Co-pays, and Prescription Drugs

- Eligible expenses not covered by insurance

- Dental Services & Orthodontics

- Eyeglasses, Contacts, Solutions & Eye Surgery

- Chiropractic, Naturopathic, Acupuncture services

- Massage – when prescribed by a medical doctor

- Mental Health Services – for individuals in your family–not marriage or family therapy

- Weight-Loss Programs – when prescribed to treat a specific medical condition

- Over-the-Counter items such as blood sugar testing kits and strips, flu shots, etc.

- Over-the-Counter medications when accompanied with a “prescription” from a medical doctor describing the medical condition the medication is for

How long do I have to submit my FSA healthcare claims for reimbursement?

You should submit claims for reimbursement during the plan year, but in no event later than 60 days after the end of a plan year. For a terminated employee or any participant who is no longer eligible under the terms of this plan, claims will still be reimbursed but only if such reimbursement requests are made by the earlier of (1) 60 days following the date that I ceased my employment or eligibility; or (2) the end of the 60-day period following the close of the plan year in which the expense arose. Any claims submitted after that time will not be considered.

If your employer has adopted either a $500 carry-over provision or an extended grace period provision in your plan documents, see below for details:

- $500 Carry-Over provision– sixty days after a plan year has ended, any remaining balances up to a maximum of $500 will carry-over into the new plan year and be made available in addition to your new year election (if any). Claims incurred in that new plan year may then be applied to the old plan year’s unused balance until it is fully reimbursed.

- 5 month extended grace period provision– if a plan year ends and a participant has an unused balance of any amount, it will be available in the following 2.5 months. A typical 12 month plan year would have a total of 14.5 months for a participant to incur charges to spend down an unused balance.

Please consult your employer to confirm if your Flexible Spending Account plan has adopted either the $500 carry-over provision or the 2.5 month extended grace period provision. Neither provision is available to terminated employees.

I am enrolled in my company’s Dependent Care Assistance Plan (DCAP). Can I lower or stop my participation in the plan because my children are at home due to schools being closed during the COVID-19 pandemic?

Yes, DCAPs do allow you to make changes to your contribution due to a change in cost or coverage. Therefore, you can stop your participation because your need for daycare has stopped. Notify your Human Resource Manager as soon as possible and complete a “Change of Status” form within 30 days of the end of your Daycare expenses. When your need for daycare returns, complete another “Change of Status” form within 30 days of your need for daycare returns. You can also change the amount of your pay period contribution so you end the plan year having contributed as much as you need or up to $5,000 as allowed by the IRS.

If the cost of the orthodontia treatment is higher than my employer’s annual maximum election limit or my annual election, can I request for the remaining balance to be reimbursed in the next FSA plan year?

Only if the orthodontia treatment continues into the next plan year. If the treatment is completed during the current year, no balances can be carried over to the next plan year.

What paperwork is required for an FSA medical, dental or vision claim reimbursement?

With a completed Claim for Reimbursement Form, it is important to send the proper documentation to substantiate your claim. The Internal Revenue Service requires that the documentation include:

- Service provider information to include name, address and phone number

- Patient information to include name, address and phone number

- Date of service

- Description of service or item

- Charges or patient responsibility

Itemized Patient Statements from service providers and Explanation of Benefits (EOB’s) from insurance carriers are perfect forms of documentation. You do not need to show proof of payment.

Dual-purpose items such as massage therapy, membership to a weight loss program, over-the-counter medicines, vitamins, herbs or supplements, require a medical practitioner’s referral that includes the diagnosis of the specific medical condition for which it is prescribed. We require a copy of that referral each time you request reimbursement for that item. Over-the-counter medications, vitamins, minerals and supplements used for general health are not eligible for reimbursement.

Why should I participate in the Flexible Spending Healthcare Account when I already have medical, dental, and/or vision insurance?

This account is used to pay for expenses not covered by insurance (see Forms Library for a list of possible eligible expenses). For example:

- Deductibles, Co-pays, and Prescription Drugs

- Eligible expenses not covered by insurance

- Dental Services & Orthodontics

- Eyeglasses, Contacts, Solutions & Eye Surgery

- Chiropractic, Naturopathic, Acupuncture services

- Massage – when prescribed by a medical doctor

- Mental Health Services – for individuals in your family–not marriage or family therapy

- Weight-Loss Programs – when prescribed to treat a specific medical condition

- Over-the-Counter items such as blood sugar testing kits and strips, flu shots, etc.

- Over-The-Counter items

- Over-the-Counter medications when accompanied with a “prescription” from a medical doctor describing the medical condition the medication is for

- Over-The-Counter items

I received an old bill and paid it in a new plan year. Is this an eligible FSA claim during this new plan year?

No. It doesn’t matter when you pay the bill. Payments for something that occurred before your plan year are not eligible. The date you incurred the expense must fall within the current plan year to be eligible to be reimbursed under the plan.

Why am I receiving emails from SBA after I swipe my FSA Debit Card?

When a participant swipes their FSA debit card, it triggers a series of emails from SBA depending on the nature of the swipe. Here is why these emails are important and what a participant can expect to receive. Read the article.

Can I submit FSA daycare expenses for reimbursement if my spouse is not employed?

If a spouse does not work, and is not disabled or a full-time student, daycare expenses are not reimbursable. If your spouse is either a full-time student or not able to care for himself or herself, your spouse will be considered to have earned income of $250 a month if there is one qualifying dependent in the home, or $500 a month if there are two or more qualifying dependents in the home. Therefore, qualified daycare expenses are reimbursable.

Can I change my FSA contributions during the year?

Only if you have a change in status such as the addition or loss of a dependent.