No group medical plan? No problem. An ICHRA (Individual Coverage Health Reimbursement Arrangement) can be a valuable, cost-saving benefit for both employers and employees. Let’s say you want to offer a plan to reimburse employees for individually-owned medical insurance premiums? An ICHRA may fit the bill, but you need to make sure the money you are offering employees isn’t going to harm them…or you.

If you are a large employer with 50 or more employees, you must offer enough money to employees or it will harm you in the form of ACA penalties. You must also meet an “affordability” standard, calculated based on an IRS affordability index. These guidelines are in place to help each employee decide if they should say yes to the ICHRA and say no to premium tax credits or say no to the ICHRA and say yes to the premium tax credits. And while employers with under 50 employees are not subject to ACA penalties nor the affordability standard, it’s just good business practice to make sure a benefit you are offering your employees, is actually a benefit to them and not a determent.

This article is to give guidance to both employees, for making that decision, and employers, to understand if they are, in fact, offering an “affordable” ICHRA.

General guidance and Safe Harbors for Employers

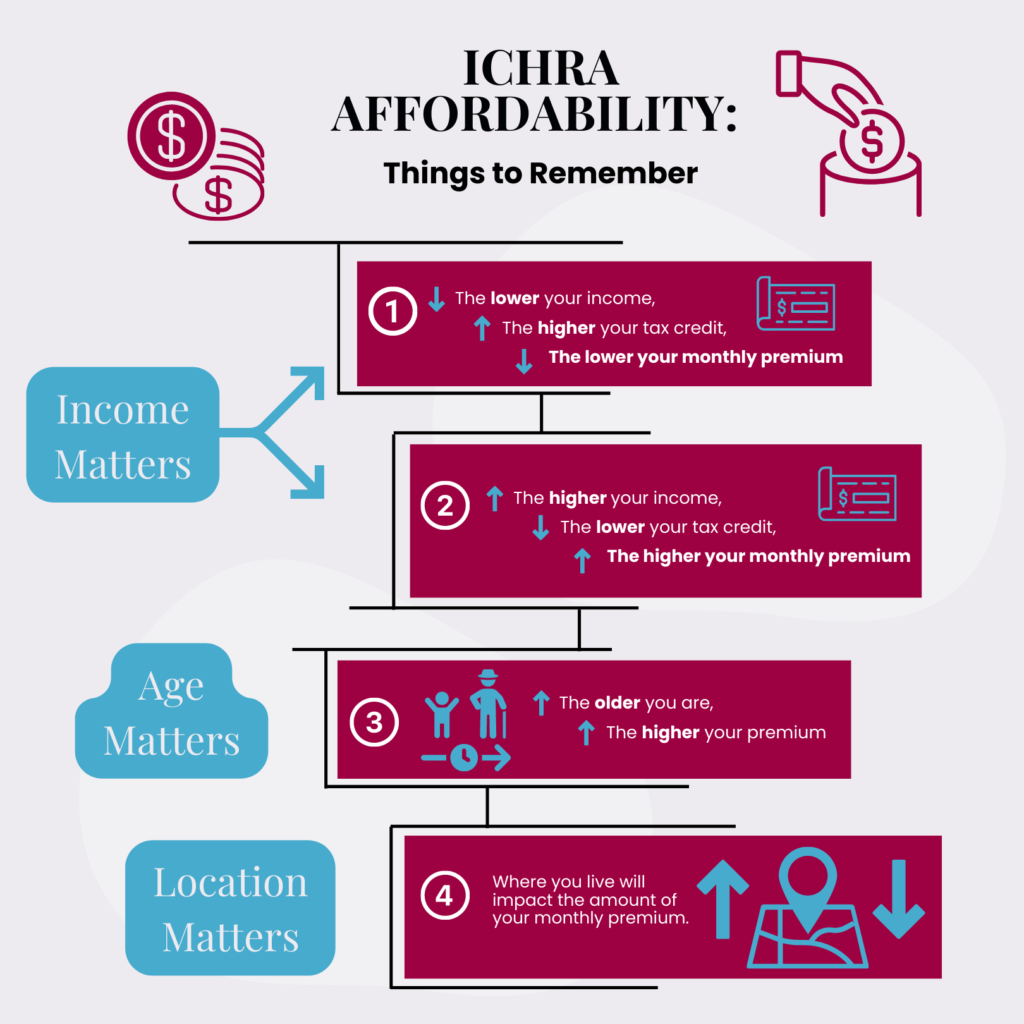

Whether or not an ICHRA can be deemed affordable is based on a number of factors. Income, age and location are the primary drivers. Large employers considering whether or not to implement an ICHRA are granted Safe Harbor parameters that can help them ascertain at a base level whether or not the ICHRA benefit will be accepted as affordable.

The Safe Harbor allows employers to:

- Assume the employee is opting for self-only coverage on the exchange. Keep in mind this will profoundly skew the affordability determination at an individual level, as a family a with coverage on an exchange will garner significantly more in tax credits than a solo individual.

- Take into account only the employee’s income as a standard for household income. To determine an employee’s income, an employer may:

- Use Box 1 W-2 income for a salaried employee

- Use one of two methods for determining the income of hourly employees:

- Option 1 for hourly employees use this formula: the hourly rate x 130 hours to estimate monthly income (even if this may not be correct)

- Option 2 for hourly employees: Use the Federal Poverty Level calculator

- Use the employer’s zip code as the location for determining the employee’s location, instead of the employee’s home address

- Use the lowest cost Silver medical plan (based on the employee’s age) available on their local exchange – this can be from the prior year instead of the following year (helpful when you want to introduce an ICHRA next year)

With these Safe Harbor parameters in mind, let’s take a look at how this plays out for an employee trying to decide whether or not to accept an ICHRA contribution.

From the Employee’s Standpoint

As an employee, your employer does not offer a group medical plan. They want to reimburse you for your individually-owned health insurance premiums. They are offering you $200 per month through an ICHRA, but do you take it? Is it beneficial for you? Let’s say you are currently receiving tax credits, which lower the cost of your premiums. If you accept the employer’s contribution, will you be giving up the tax credits? Yes. The decision to accept the employer ICHRA contribution or continue to use the tax credit is solely up to you. How do you know if you should say yes or no to that offer so you are not harmed by giving up those premium tax credits. Let’s walk you through how to make the decision. Before we start looking at examples, here are four things to keep in mind:

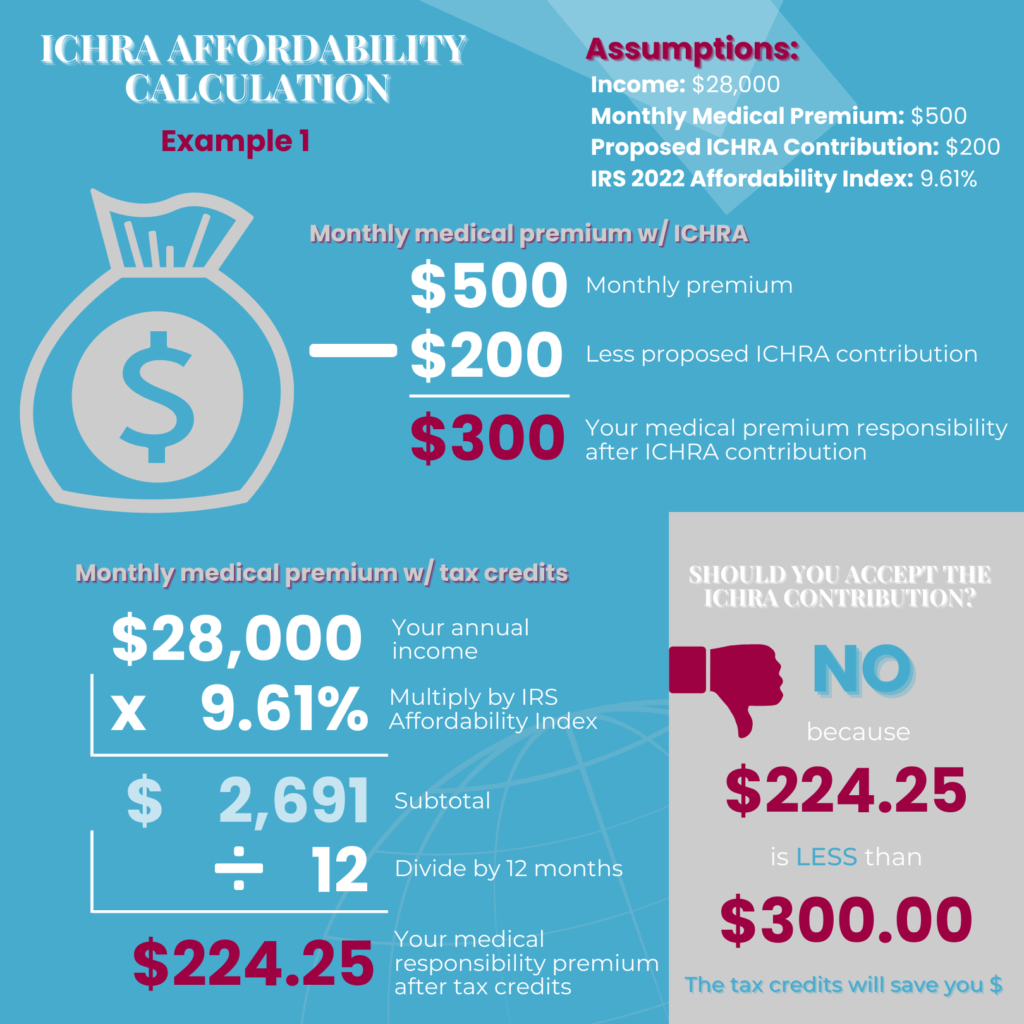

Now, let’s look at some examples. For each example we’ll assume that you are paying $500 per month* for insurance and your employer is going to reimburse you $200 through an ICHRA. Note that this is a $300/mo. difference.

*The plan you choose on the exchange (Gold, Silver, Bronze), for affordability purposes is irrelevant, as the employer must consider the local rate for the lowest cost Silver plan as a standard for the affordability calculation.

Example #1: Salaried Employee

In this example, you are 25 years-old and your income is $28,000/yr. Every year, the IRS publishes an affordability index percentage that you can use to help you determine whether or not you are better off accepting the employer’s ICHRA contribution or continuing to take premium tax credits. To make this calculation, multiply your income by the applicable IRS Affordability percentage (9.61% for 2022 at the time of writing this article). Divide that outcome by 12 months to arrive at a monthly affordability number. Spoiler alert: in this example it’s $224.25. Should you take the tax credits or the ICHRA contribution?

Because this number is less than the $300 premium difference, this ICHRA contribution is not deemed affordable for you. You should say no to this employer offer of $200 per month through an ICHRA and continue using the tax credits.

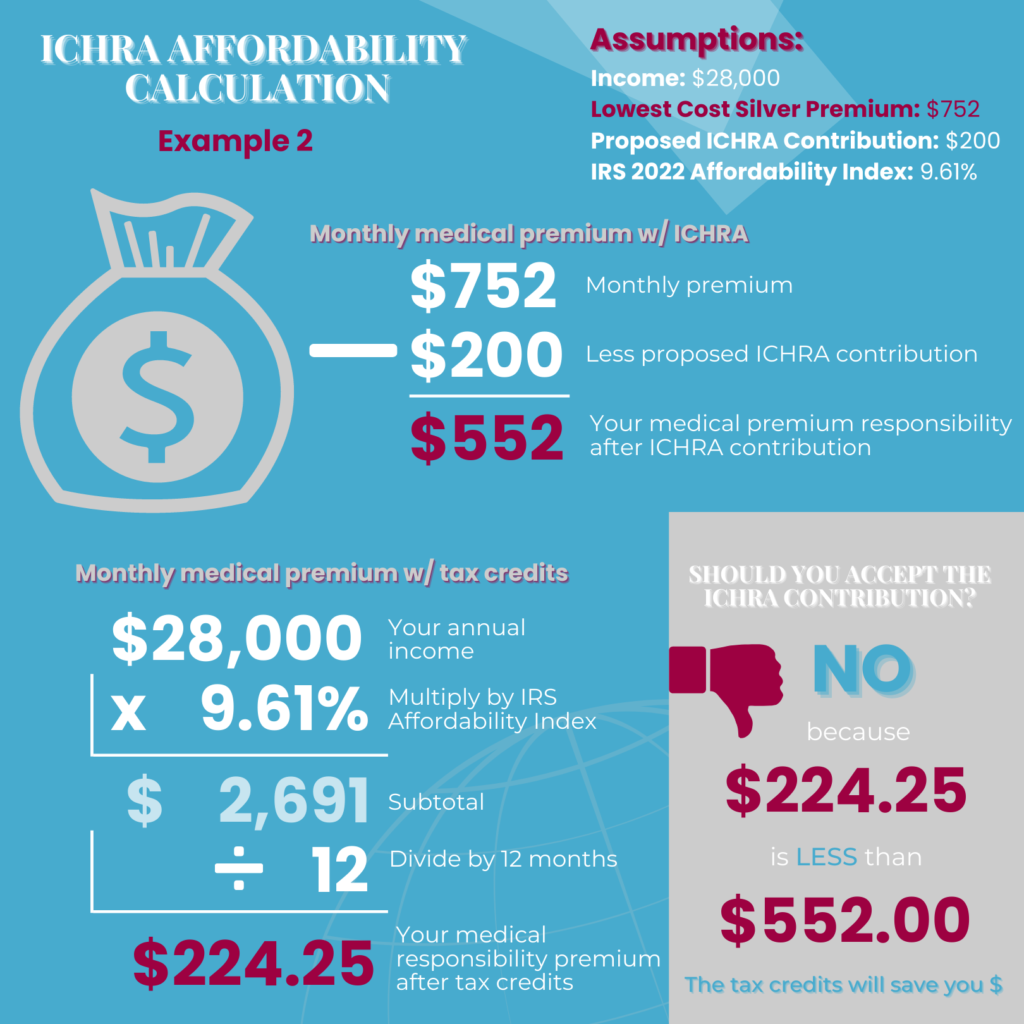

Example #2: Older salaried employee

As we stated earlier, monthly premiums will vary based on your age. For this example, we are using the premium for a 56-year-old’s Silver $6500 deductible plan (which is the lowest Silver plan in SBA’s zip code at the time of writing this article). It is $752/mo. Here is the new calculation:

Again, the employee in this example would be better off rejecting the employer’s ICHRA contribution and accepting the tax credits.

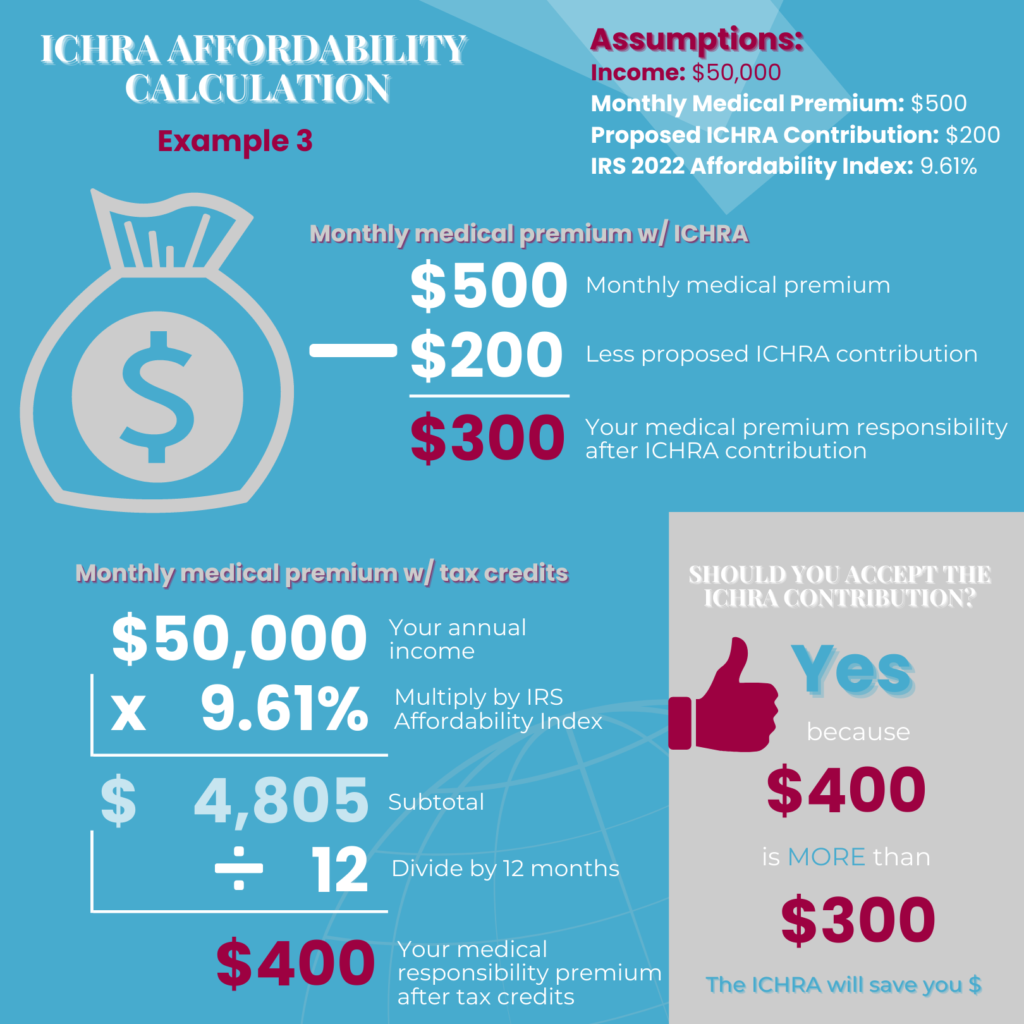

Example #3: Younger employee making $50,000/yr

When does an ICHRA contribution make sense? Generally, if an employee has more income, is younger and the $500 premium is more than a low cost Silver plan. Take a look:

What about hourly employees?

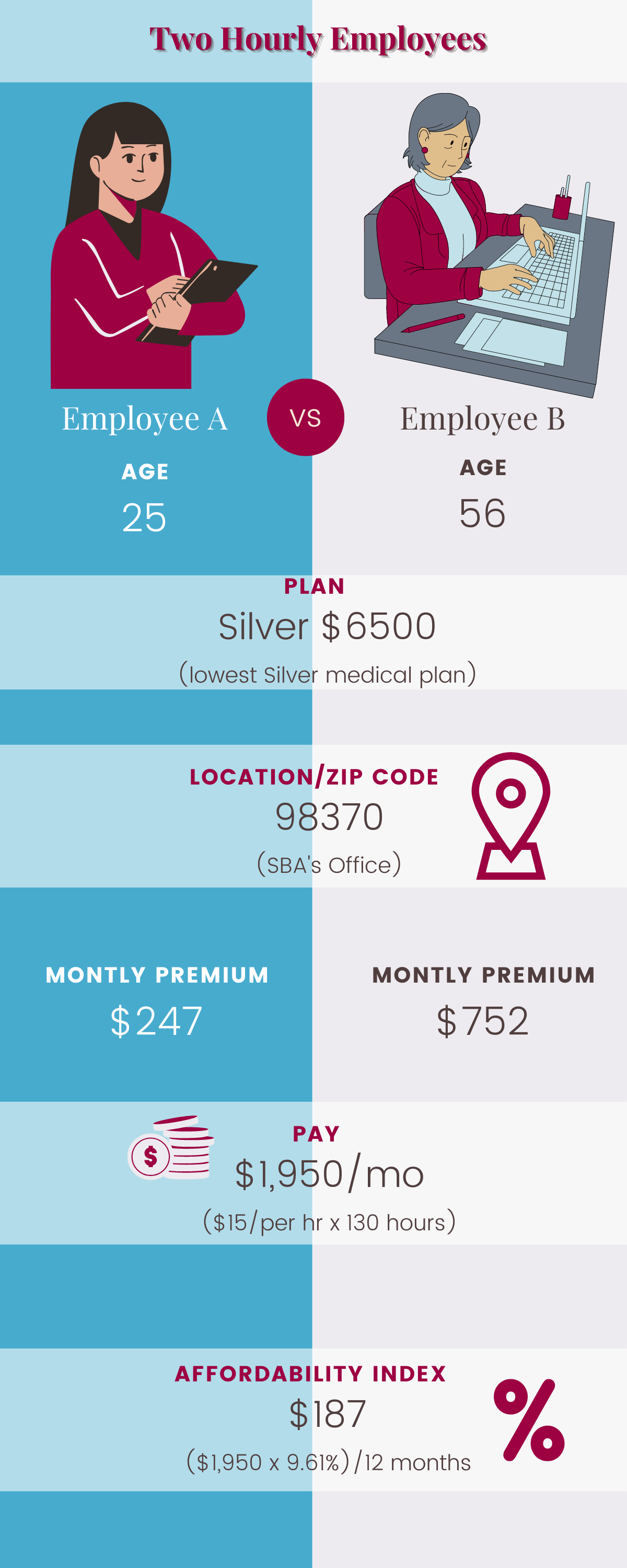

In our first 3 examples, all of our employees have been salaried, but what if they are paid hourly. Their income can be highly variable right? So how can an employer determine affordability? Remember earlier in the article we outlined two different methods for determining an hourly employee’s income. Let’s look at our two original employee examples (one age 25 and the other age 56) and how the outcome of affordability using the two different method varies.

For these examples, we are using the WA State Exchange for SBA’s zip code (2022) and assuming employees are both paid $15.00 per hour:

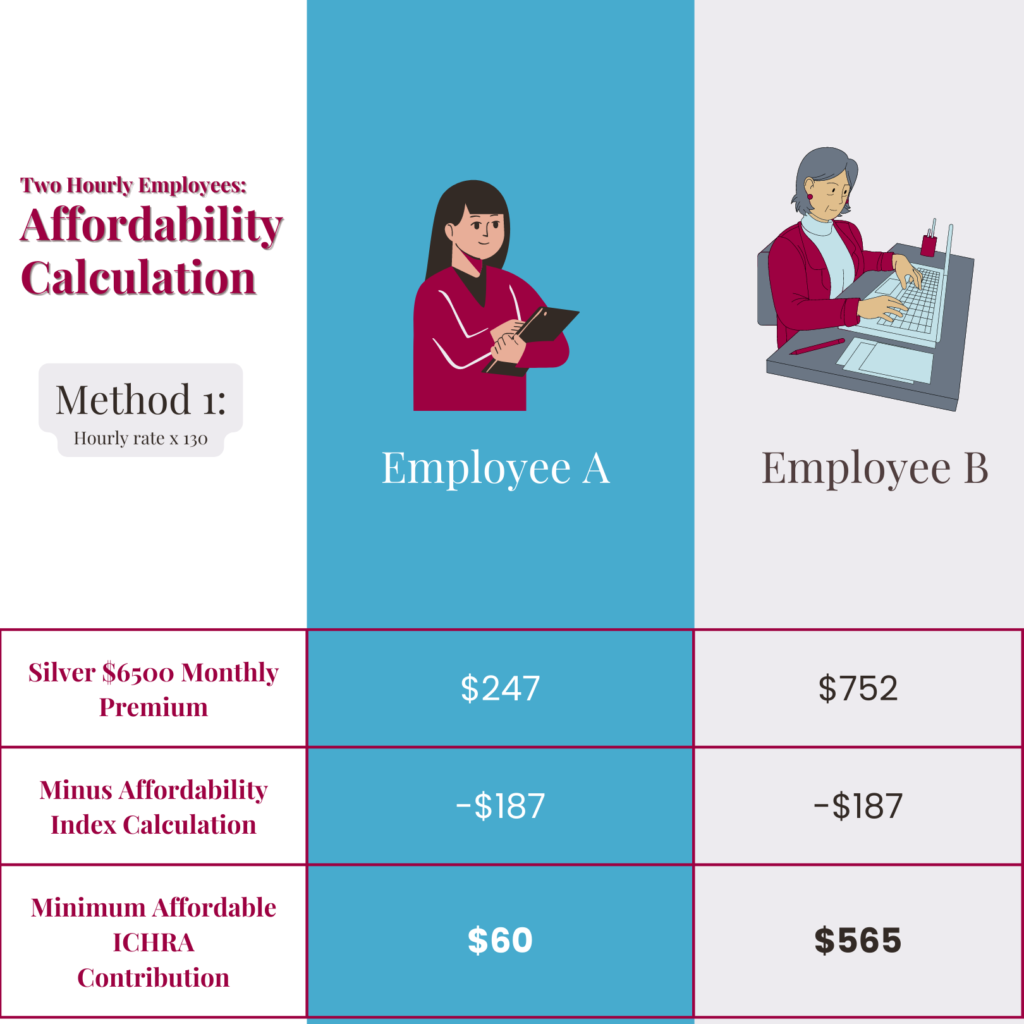

Method #1: Hourly Employee Income Calculation

Per the guidelines for method #1, we assume each employee works 130 hours per month:

In this scenario, an employer would have to make an ICHRA contribution of more than $60/month for the younger employee and more than $565/month for the older employee to have it deemed affordable.

Now let’s look at the alternative method for calculating income for hourly employees.

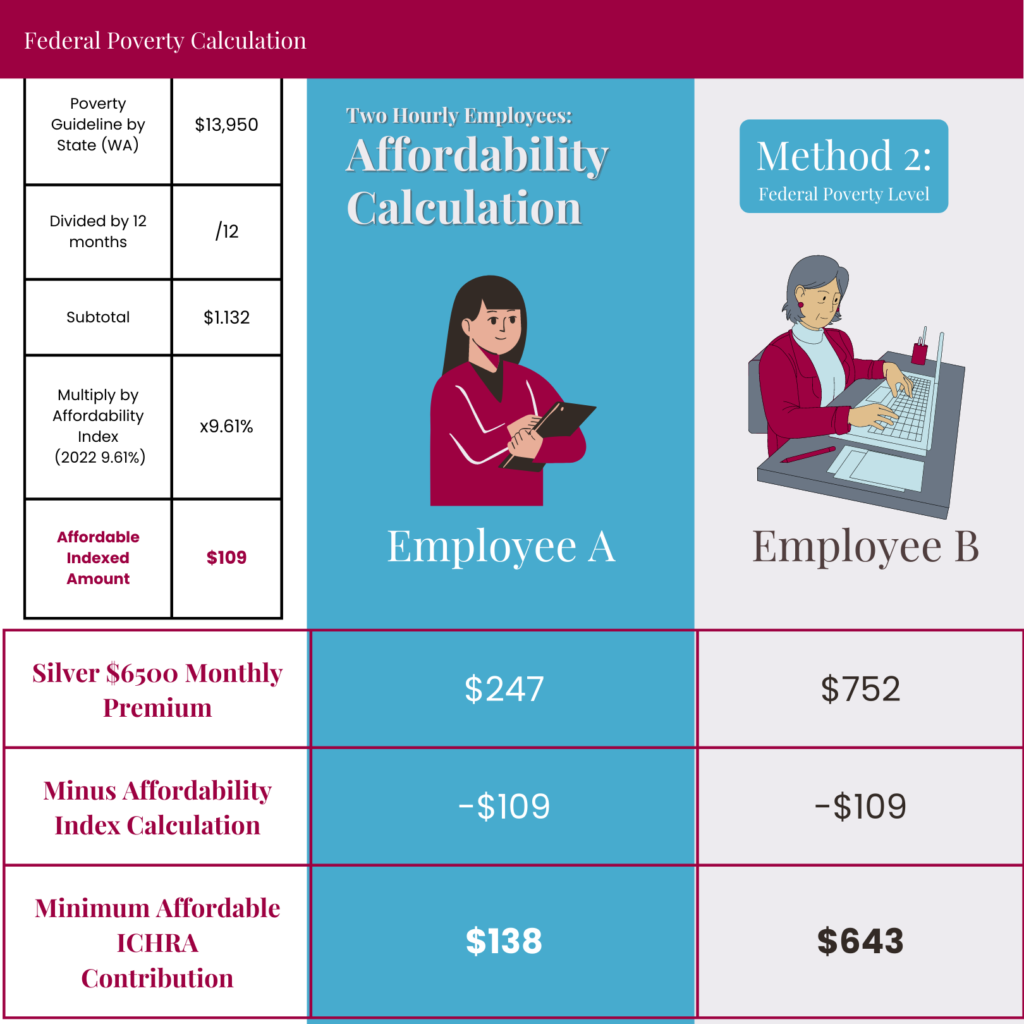

Method #2: Hourly Employee Income Calculation

Here is how the same employees fare with the method #2 for hourly employees by using the Federal Poverty Level for 2022 (Keep in mind that we don’t know if the employee has dependents, but to meet the Safe Harbor, we don’t need to know this information). For WA state, the poverty guideline is $13,590 divided by 12 months = $1,132.50 per month x the affordable indexed amount of 9.61% for 2022 = $109

In this case, Method #1 gives a more employer-friendly affordability alternative, but depending on your employee population, this may not always be the case. Keep in mind it is entirely up to the employer which method to use for determining affordability, it just must be applied uniformly.

Some final thoughts and considerations

-

- From our examples, it’s clear that what is affordable for the younger employee vs. for older employees is vastly different regardless of whether salaried or whatever hourly method is used. The good news is you can vary ICHRA reimbursement amounts by age to help older employees with higher premiums due to age-banded rates.

- As we mentioned, the Safe Harbor requirement to only consider an employee who would elect self-only coverage on an exchange greatly skews the true affordability factor of an ICHRA contribution vis a vis the higher tax credits available to the employee (with family coverage). As with age, an employer is also allowed to vary ICHRA contributions by sole vs. family coverage.

- To ensure that your ICHRA is actually affordable for your employees requires a deeper dive at an individual employee level. A short employee survey may help you design an optimum ICHRA benefit that everyone will enjoy. Here are the questions to ask your employees:

-

- Do you have an individually-owned medical insurance policy: Yes or No

- If yes, does your medical policy cover family members other than yourself: Yes or No

- What is the full monthly medical premium before any tax credits that may apply: $___________

- What is the monthly tax credit amount which lowers the amount you pay: $__________

By obtaining this information, you can run the calculations and determine whether the amount you are considering for an ICHRA contribution will in fact be a benefit to all your employees.

Phew! This is a lot to digest! Remember, large employers with 50+ employees MUST offer Affordable coverage while it’s optional for employers with fewer than 50 employees to offer Affordable coverage. Feel free to play with the numbers or ask us to help you figure out what’s affordable for your employees when offering an ICHRA.