Last month’s blog article addressed domestic partners (non-married of any sex – not spouses) and pre-tax savings programs such as Flexible Spending Accounts (FSA), Health Reimbursement Arrangements (HRA), Health Savings Accounts (HSA) and Premium Only Plans (POP). What about COBRA eligibility for domestic partners?

What does the Consolidated Omnibus Budget Reconciliation Act of 1985 (otherwise known as COBRA) say about domestic partners and continuation coverage? (Note: this article refers to the COBRA regulations, not the unpredictable variance where insurance carriers might apply more liberal or strict application of domestic partner continuation coverage. We address this wrinkle in the last section of this article.)

Strictly by the book, domestic partners are not legal dependents. Therefore, they are not COBRA qualified beneficiaries and do not have independent rights to elect COBRA. Only covered employees, spouses (opposite sex or same sex) and dependent children (could be children of domestic partners) are COBRA qualified beneficiaries with independent rights to elect COBRA.

But, wait…there’s more

If an employee and covered domestic partner lose coverage due to the employee’s termination of employment or reduction of hours, the employee may elect to continue the same coverage in place before the qualifying event, which included coverage for the domestic partner. The reason the domestic partner is covered under COBRA in this scenario is because of the COBRA rule that COBRA coverage must be “the same coverage that the qualified beneficiary had on the day before the qualifying event” and must not differ in any way from coverage made available to active employees. However, the domestic partner may not elect COBRA coverage independent of the employee’s election.

Additionally, a COBRA participant may add a domestic partner to COBRA coverage at open enrollment if active employees can do the same. A new domestic partner, however, cannot be added to COBRA benefits outside of open enrollment (mid-plan year), as a legal spouse might be able to due to HIPAA Special Enrollment rules.

What if the domestic partnership dissolves?

An active employee who has an insured domestic partner who dissolves the partnership during the plan year may drop the domestic partner mid-plan year from insurance, but no COBRA Election Notice is mailed to the ex-domestic partner. The result is the same in the case of death of the employee.

The termination of a domestic partnership is not listed as a COBRA qualifying event due to the fact that a domestic partner is not defined as a spouse in a divorce or legal separation. This is true even if it took the form of a formal dissolution in a State, for example, providing registered domestic partnerships. While a court might interpret the term “legal separation” (which is not defined by COBRA) to encompass the dissolution of a registered domestic partnership, the domestic partner would still not be a qualified beneficiary with COBRA rights due to the legal separation.

What about children?

Children of domestic partners can be qualified beneficiaries with independent COBRA rights. COBRA does not define the term “dependent child.” If an active employee, who has insured a domestic partner and child(ren) of the domestic partner, dissolves the relationship mid-plan year, a COBRA Election Notice is mailed to the child(ren) who were covered by the employee. What would the COBRA qualifying event be? It’s Loss of Dependent Status of course! Here is where it gets really strange. If the child of a domestic partner elects COBRA due to Loss of Dependent Status and open enrollment rolls around, that child can add his/her parent (the ex-domestic partner) to COBRA coverage. Talk about the effects of unintended consequences!

The sticky part about insurance carriers

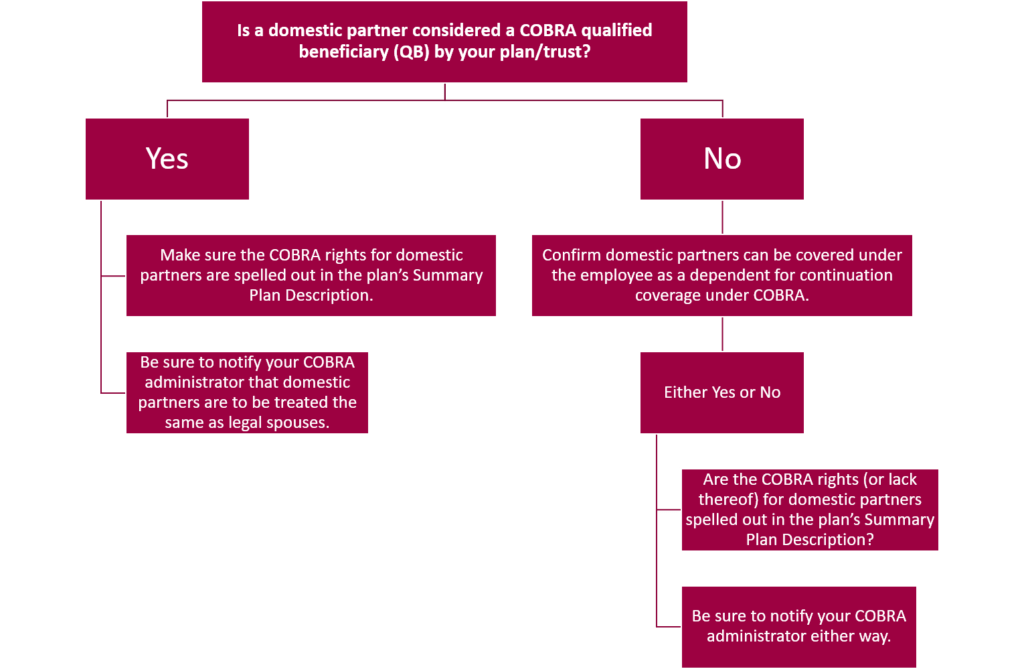

If an employer allows domestic partners to enroll in group benefits, it is advisable to consider continuation coverage issues when addressing health coverage for domestic partners. Even though, by Letter of the Law, a domestic partner is not considered a qualified beneficiary under COBRA, some insurance companies may make exceptions to the rule. Below are some questions to ask the insurance carrier:

In Washington State, each insurance carrier has rules for handling COBRA for domestic partners. Some trust/associations or large plans (50+) do not allow domestic partner healthcare coverage, and if they allow them to enroll on the plan, they may treat them differently by denying them COBRA continuation coverage entirely. Some carriers have restrictions such as requiring the domestic partnership be registered in that state (different states have different registration requirements) with documented proof required when first enrolled in health coverage.

As you can see, while COBRA Law is concise, practical application with the insurance carriers may vary. The topic of domestic partner insurance coverage has changed over the years and will continue to evolve. We’ll keep you updated as the rules and practical application of the rules change.