Even though the COVID-19 pandemic is not over, the special one-year extended relief time that began March 1, 2020 for completing COBRA elections and payments is set to expire on February 28, 2021. This relief set guidelines for administering COBRA during an undefined period of time deemed the “Outbreak Period.” From 3/1/20 – 2/28/21, as long as the Outbreak Period remained in place, you’ll recall, qualified beneficiaries who experienced a COBRA qualifying event during that time could elect COBRA and pay for it at anytime during that period. To date, the IRS and DOL have remained mum about any plans to extend this Outbreak Period and the expiration of the extended relief is mere days away. Now what?

What happens when/if the Outbreak Period Expires?

Assuming we don’t receive guidance from the IRS and DOL prior to March 1, 2021, EVERY QUALIFIED BENEFICIARY who terminated between 3/1/20 – 2/28/21 has:

- 60-days from March 1, 2021 to retroactively elect COBRA

- 45-days from March 1, 2021 to submit all retroactive COBRA premiums once COBRA coverage is elected

- 30-days to make monthly COBRA premium payments (ongoing payments)

While that may sound simple, just with SBA clients alone, the number of affected qualified beneficiaries is in the thousands. There is also talk of Congress implementing COBRA subsidies. If a subsidy plan materializes, (flashback to 2009) where the government pays 65% of an involuntarily terminated employee’s premium and the ex-employee only pays 35% of the premium, we’re looking at an administrative apocalypse!

The feds could swoop in at the last minute…days…months later and tinker with any or all of the above.

What Could Happen?

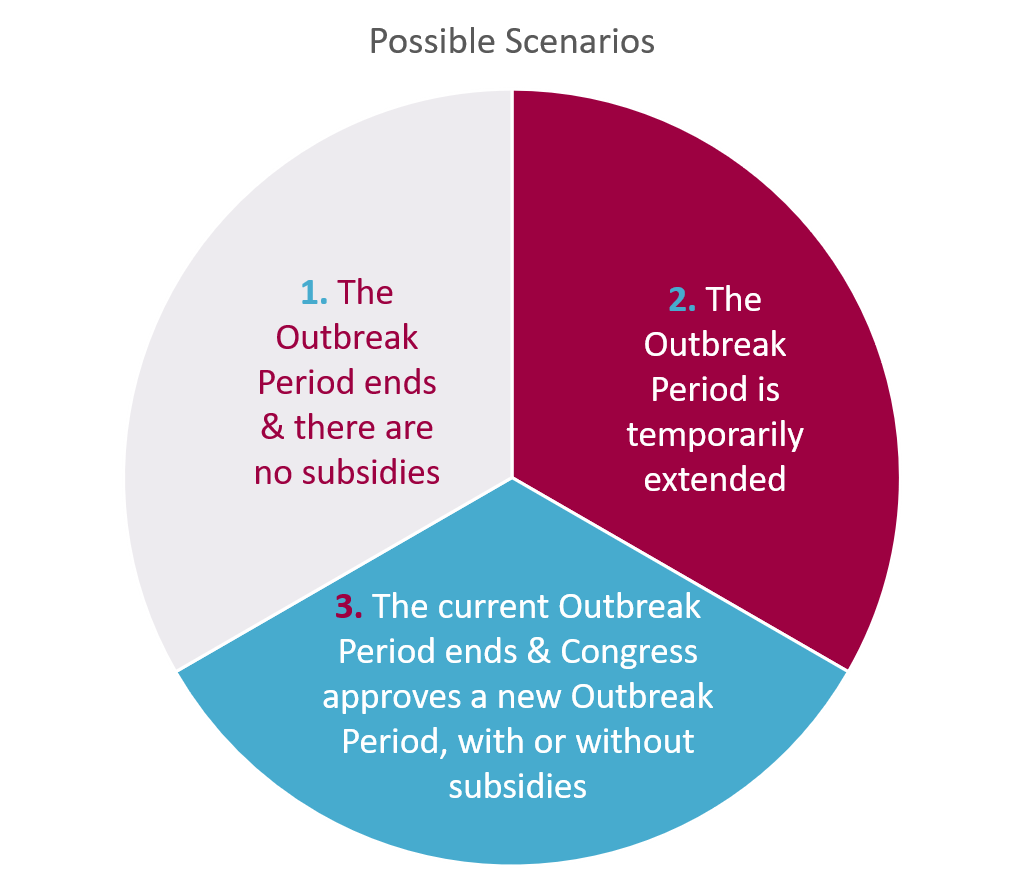

While predicting future congressional and agency moves is challenging, it is possible that Congress, the IRS and DOL may identify other avenues to provide additional relief.

- The Relief Period ends and there are no subsidies.

One possibility is that Congress lets the period end and does not approve financial assistance to those in need. While it provides an end date which starts the 60-day COBRA clock for payments, elections, and notices, the economy and the job market are still depressed. Millions of people could find themselves without a job, without a way to pay for COBRA premiums, and without health insurance.

2. The Outbreak Period is extended temporarily.

Another possible outcome is that Congress or other federal agencies approves a temporary extension to the ERISA dates, perhaps in 30, 60 or 90 day periods. This gives people who have not been able to

find employment more time to keep their healthcare coverage. It could also give Congress additional time to work out a deal on COBRA subsidies. As well, it pushes out those dates for making payments, notices, etc., keeping the current situation in limbo.

3. The current Outbreak Period ends and Congress approves a new Outbreak Period, with or without subsidies.

Under this situation, the current Outbreak Period could expire, starting the current 60-day clock for COBRA timelines. Then, new legislation could designate a second Outbreak Period with a new date for starting the 60-day COBRA timeline clock. It could also include COBRA subsidies, either tied to a new timetable or applied retroactively to the previous Outbreak Period.

Life in Limbo

As the clock ticks, and it’s looking less and less likely that we will get definitive guidance before Monday’s deadline, this already complicated compliance juggernaut gets even more complex. We have little guidance on how to administer COBRA for all those thousands of participants who became qualified beneficiaries during the Outbreak Period.

Let’s look at a few examples of potential landmines:

- Administrative Issues. The Outbreak Period guidelines say that a qualified beneficiary has 60 days to elect COBRA after the Outbreak Period ends. Sounds simple in practice but, say you have an employee that terminated in May, 2020 and now in March, 2021 elects to take COBRA. How do we and the insurance carriers administer on a retroactive basis?

- Balloon Payment Issues. During the Outbreak Period, a qualified beneficiary does not have to pay any premiums until 60 days after the end of the Outbreak Period. You could have an employee who lost her job in April, 2020. Her premiums are $500 per month, but she hasn’t yet elected to enroll in COBRA and therefore chosen not to pay any of her monthly COBRA premiums. If the Outbreak Period actually ends on February 28, 2021, and she decides she wants to enroll retroactively, she will owe $5,000 (10 months) of premiums by the end of April, 2021. What happens if she doesn’t pay? If she’s still interested in COBRA – that means she probably hasn’t found another job. What are the chances that she’s been saving up $5,000 to pay off her COBRA debt?

- Notification Issues. Some legal experts have cautioned that suspended notifications to qualified beneficiaries could increase claims of a breach of fiduciary responsibilities. As yet, the IRS and DOL have not addressed whether administrators should update previously sent COBRA election notices. One could argue that the fact that COBRA election notices are not required until the end of the Outbreak Period suggests that interim corrections are not required. But, barring definitive guidance, the question of exposure to liability exists.

And so we wait…

Chances are March 1 will come and go and we’ll wait until the waning days of April (April 29th is 60 days after the Outbreak Period ends and all Outbreak Period extensions expire) to see if the feds extend any form of relief or grant subsidies. In the meantime, we’re prepping in Poulsbo for whatever changes are made – be it a paperwork nightmare or a phone call apocalypse.