Be it an ineligible expense or a lack of back-up, sometimes we deny an FSA or HRA claim. Can the participant appeal and, if so, what is the process? Gina explains.

Question of the Month: What is the difference between a grace period and a run-out?

They both are extensions of time, but what they allow extensions for are different. Gina explains FSA/HRA run-outs and grace periods in our Question of the Month.

Question of the Month: What is the easiest way to use my unspent FSA funds?

This is a question we get a lot this time of year. And this year we have a great new answer.

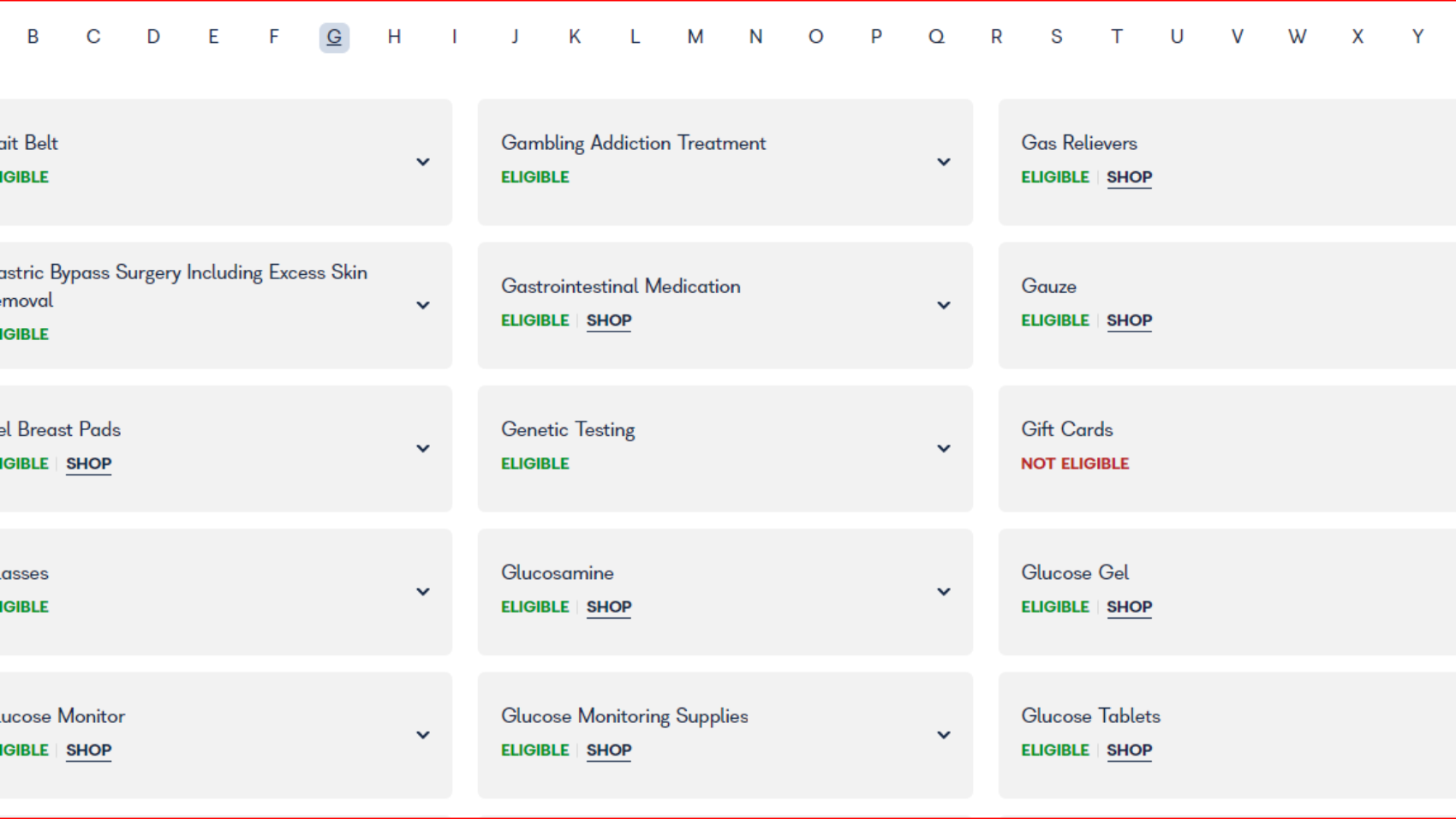

SBA & The FSA/HSA Stores: A Match Made in Alphabet Soup Heaven

Why did we wait so long to form this partnership and why is it a win for everyone? Here are the answers to these burning questions.

Question of the Month: What the heck is a dual-purpose item and is it an eligible expense?

Sometimes there is a fine line between what is considered an eligible expense. Gina answers the question of when an item crosses that eligibility line.

Question of the month: After termination, when do pre-tax programs end?

When an employee terminates, pre-tax programs don’t necessarily follow the same timelines as medical plans. Gina explains.

The Clock is Ticking: The End of the National Emergency Rules for FSAs/HRAs is Near!

The National Health Emergency has ended. What does this mean for FSA and HRA claims? Find out!

A Wealth of Flexibility: Employer Contributions in Health Flexible Spending Accounts

Employers can contribute to an employee’s Health FSA account, and in fact, they have multiple options. Gina explains.

Question Of The Month: Are fertility treatments eligible expenses?

There are a wide variety of procedures and treatments available to help women conceive, but are they FSA/HSA eligible?

Question of the Month: Are automatic pill dispensers FSA eligible?

Is smart technology to dispense your medications eligible for FSA reimbursement? Gina has some thoughts on this new medical device.