Be it an ineligible expense or a lack of back-up, sometimes we deny an FSA or HRA claim. Can the participant appeal and, if so, what is the process? Gina explains.

Question of the Month: What is the difference between a grace period and a run-out?

They both are extensions of time, but what they allow extensions for are different. Gina explains FSA/HRA run-outs and grace periods in our Question of the Month.

Question of the Month: What happens when you outgrow a QSEHRA?

Yay! Your company grew! But Yikes! Are you too big for your QSEHRA?

We’re sorry, you really aren’t COBRA eligible.

What happens if someone who thinks they should get COBRA turns out not to be eligible? Gina has the answer.

Is a Medical Cost Sharing Plan a Pre-Tax Benefit?

Medical Cost Sharing Plans, also known as health sharing plans, are a way for employees to trim benefits costs. But it’s important to understand the limitations and rules – or lack thereof – before making the switch from a traditional group medical plan.

Question of the Month: What is the easiest way to use my unspent FSA funds?

This is a question we get a lot this time of year. And this year we have a great new answer.

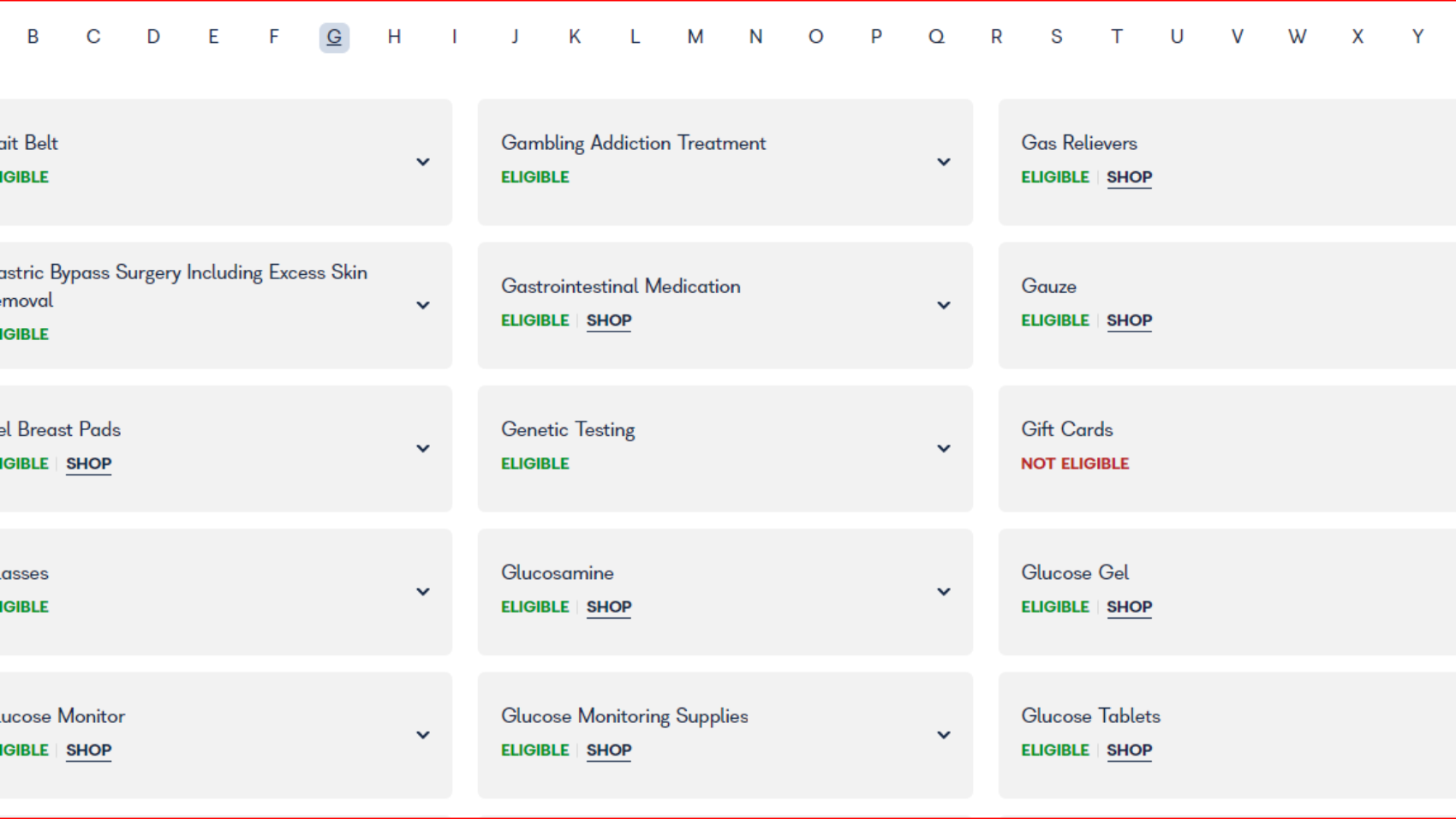

SBA & The FSA/HSA Stores: A Match Made in Alphabet Soup Heaven

Why did we wait so long to form this partnership and why is it a win for everyone? Here are the answers to these burning questions.

Question of the Month: What the heck is a dual-purpose item and is it an eligible expense?

Sometimes there is a fine line between what is considered an eligible expense. Gina answers the question of when an item crosses that eligibility line.

Once again with feeling, NO, you can’t pay your employee’s Medicare premiums…unless…

We may sound like a broken record, but for the multitudes who will ask, here is the resounding answer regarding employers paying for Medicare premiums.

Question of the month: After termination, when do pre-tax programs end?

When an employee terminates, pre-tax programs don’t necessarily follow the same timelines as medical plans. Gina explains.