FSA Administration

What we do

As your FSA Administrator, SBA will work with you from the plan design, through enrollment and all year long, monitoring compliance, providing reporting and claims administration.

Why SBA for FSA Plan Administration?

Flexible Spending Accounts remain a valuable tool for helping employees pay for out-of-pocket medical expenses on a pre-tax basis. In fact, today, these plans have more options available to increase access to contributions.

SBA will work with you to explain not only how an FSA plan works, but how these plan options can help employees avoid the use-it-or-lose it part of the plan – one of the drawbacks of participating in the past. We will work with you to recommend a plan design that suits your needs based on employee turn-over.

FSA plan design options include:

- Issuance of debit cards for qualified expenses.

- $500 Carry-Over provision.

- 2.5 Month Extended Grace provision.

- Limited-Purpose FSA accounts allowing HSA participants to participate in an FSA on a limited basis preventing them from having “impermissible coverage.”

- Online access to participant account balances with individual claim detail history.

For ongoing FSA administration, SBA will:

- Provide a signature-ready group application to the decision-maker based on plan design and administrative reimbursement method

- Create an enrollment handout to be used at enrollment meeting(s)

- Send a representative, depending on location, to the employer location(s) to explain how an FSA works

- Enroll participants in the plan and send a participant handout

- Draft new plan documents which include Adoption Agreement, Plan Document and Summary Plan Description

- Conduct non-discrimination testing of the plan and let the employer know if participant elections need to change to meet testing demands

Search

Our latest subject matter articles

FSA/HRA Claim Denied? What now?

Be it an ineligible expense or a lack of back-up, sometimes we deny an FSA or HRA claim. Can the participant appeal and, if so, what is the process? Gina explains.

Question of the Month: What is the difference between a grace period and a run-out?

They both are extensions of time, but what they allow extensions for are different. Gina explains FSA/HRA run-outs and grace periods in our Question of the Month.

Question of the Month: What is the easiest way to use my unspent FSA funds?

This is a question we get a lot this time of year. And this year we have a great new answer.

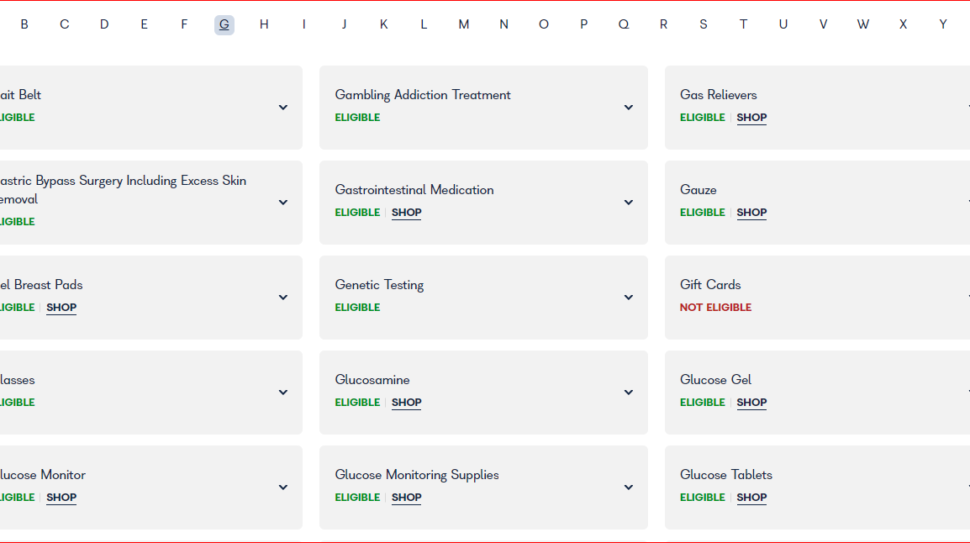

SBA & The FSA/HSA Stores: A Match Made in Alphabet Soup Heaven

Why did we wait so long to form this partnership and why is it a win for everyone? Here are the answers to these burning questions.

Question of the Month: What the heck is a dual-purpose item and is it an eligible expense?

Sometimes there is a fine line between what is considered an eligible expense. Gina answers the question of when an item crosses that eligibility line.