Blog

Qualified Transportation Plans: Help employees go green, avoid traffic and save money!

As companies and employees struggle with traffic in our region, a Qualified Transportation Plan could offer some tax relief! Learn more.

July Question of the Month: Does hitting 20 employees mid-year trigger COBRA eligibility?

This month our expert answers the popular question, “if my company hits 20 employees mid-year, does that trigger COBRA eligibility?” Find out!

True or False: Is Medicare Entitlement a COBRA qualifying event?

While listed as a “COBRA Qualifying Event,” in most cases, a spouse will be rejected upon submitting the COBRA application. Find out why.

Keep an eye out for info on PCORI fees!

Employers who have an HRA or contribute to an employee’s FSA account are required to pay a PCORI fee – due July, 31. Learn more.

June Question of the Month: Can I get FSA reimbursement for concierge fees?

June Question of the Month: Can I get FSA reimbursement for concierge fees?

Question of the month: Are yoga classes and massage sessions HSA eligible expenses?

Our Alphabet Soup Expert, Gina Marken, answers this month’s burning question: Are yoga and massage HSA eligible expenses?

The New QSEHRA Isn’t One-Size-Fits-All

The QSEHRA hit the scene with fervor, but buyer beware, it isn’t for every small employer. Make sure you understand the complicated rules and lurking questions or you could end up costing the employees you are trying to help.

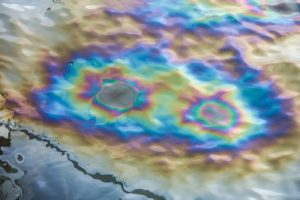

Ask the Expert: Do Medicare and COBRA mix?

Do Medicare and COBRA mix? Or are they more like oil and water? Our guest expert is Jan Cammack, Broker and Medicare Specialist with GHB