For years now I have written articles on topics I’m asked to research. We’ve built up quite a library. It has become an invaluable tool that I refer to often. One frequently-asked topic, however, has slipped through the cracks: Can an employer contribute to FSAs? The answer is yes, with some quirky qualifications. So, here is my long-overdue article that we all can refer back to when the inevitable question comes up again.

With respect to employer FSA contributions, here’s what EBIA (Employee Benefit Institute of America) says about nonelective employer contributions:

“The maximum annual benefit payable to any participant must not exceed two times the participant’s salary reduction election for health FSA benefits for the year, or if greater, the amount of the participant’s salary reduction election for the year plus $500. Cashable employer contributions are treated as salary reductions for this purpose. The IRS annual benefit amount cannot be exceeded.”

What does that mean?

-

- If the employee contributes between $0 and $500 to his/her Health FSA, the employer can contribute up to $500.

-

- If the employee contributes more than $500,

- the employer could match dollar-for-dollar the employee contribution, or

- the employer could match a certain percentage of the employee contribution, or

- the employer may choose to match up to a certain limit

- If the employee contributes more than $500,

Note: the total employee + employer contribution cannot exceed the annual IRS maximum.

Still clear as mud?

There are any number of ways an employer could choose to match employee Health FSA contributions. Here are just some examples of how employer contributions might work:

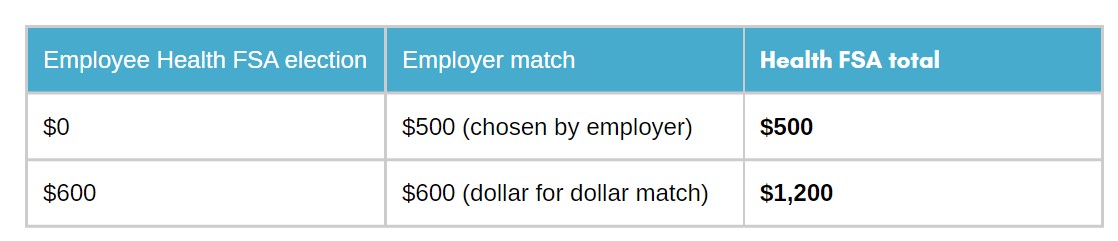

Let’s assume a $500 match for all, then dollar for dollar above $500 in employee contributions (up to IRS max):

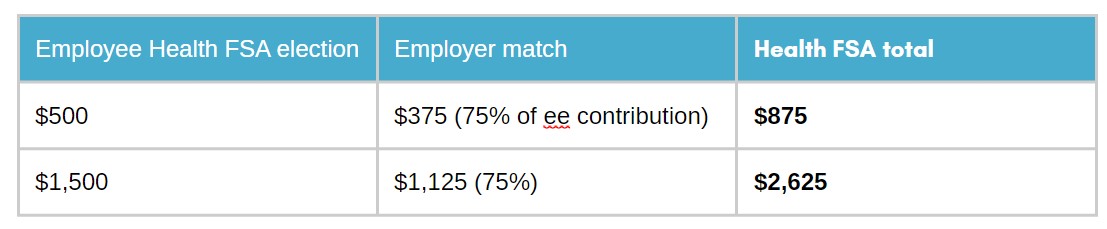

A percentage of the employee contribution – let’s say 75% (up to IRS max):

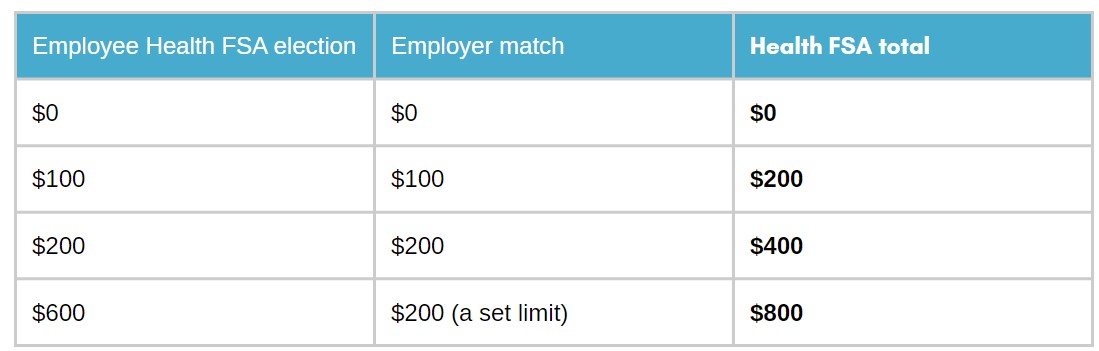

A set maximum one-to-one dollar match – let’s say up to $200 (up to IRS max):

Are there other types of plans that allow employer contributions?

Another type of FSA plan with employer contributions is one that involves flexible credits. I’ve heard them called Defined Contribution Plans; I participated in one back in the 1990’s. We do not administer these plans and they are not as popular as they once were.

In this type of plan, an employer makes a certain amount of money available to employees to spend on an array of employee benefits like medical, dental, vision, Health FSA, Dependent Care Account, Health Savings Account, short-term disability, long-term disability, and retirement accounts. The employee would take these “employer credits” and apply them to whatever available benefits they choose. If the money didn’t go as far as the employee wanted, they would pay the balance of the cost with pre-tax dollars through a salary reduction. However, with ever-rising healthcare/benefits costs, that “pot of money” just doesn’t go as far as it did in the 1990’s, hence the decline in interest in these plans.

The bottom line

An employer looking to add contributions to a Health FSA should consider their end goal. Is it to increase participation in the plan? Reward participants for contributing more? Or, simply allow additional funding for employee out-of-pocket expenses. Maybe it’s a combination of all the above – you have the flexibility! Ready to get started? Contact us and we can help you arrive at a formula that works best for you.