Fighting soaring health insurance premiums? Here’s a creative, out-of-the-box (even brilliant) strategy that just might make you a superhero with your clients: an ultra-high HDHP deductible with an HSA/HRA combo – yes, you heard me, combo. The mix means a lower premium for the employer, measurable upside risk and limited employee out-of-pocket liability – but the brilliant part is that the participant is still HSA eligible. Got your juices flowing?

How the heck does this brilliant idea work?

Picture this – using a single coverage participant:

- Employer implements a $3,000 (single) deductible HDHP medical plan that is HSA-qualified

- Participant is required to meet the first $1,400 of the medical deductible (that’s the 2020 minimum IRS required HDHP deductible)

- Employer pledges to reimburse 100% of the remaining deductible up to $1,600 through an HRA

- Participant’s HSA eligibility is still intact, meaning participant can contribute up to the maximum of $3,550 (2020) into an HSA account (age 55+ can add an extra $1,000)

The employee benefit is significant

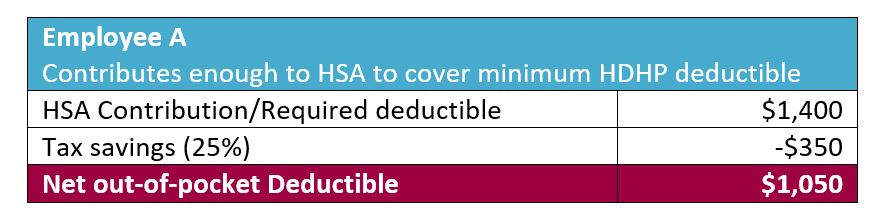

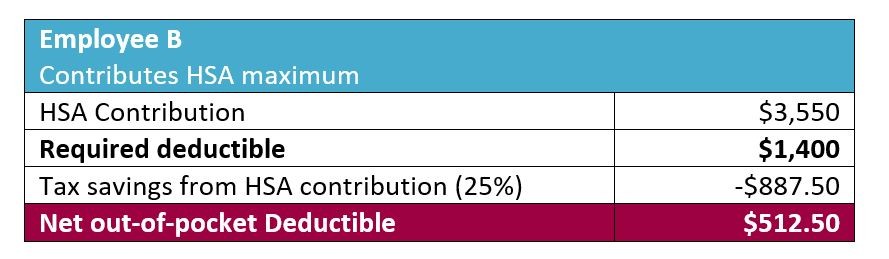

Think about this for a minute, if the employee contributes anything through payroll deduction to their HSA bank account, they will be saving 25-30% in payroll taxes (Federal, Social Security and Medicare taxes). Let’s look at a couple of examples:

What? A $500 deductible? I haven’t seen one that low in years!

Why does this work?

Because the HRA is limited in scope (i.e. only reimbursing above the minimum HDHP deductible) the participant maintains their eligibility to contribute to their HSA.

The employer benefits too

You may be thinking, “Why wouldn’t the employer just contribute dollars to the employee’s HSA and let the employee deal with the rest of the deductible themselves?” Good question. Let’s use our example above and look at two employers with 10 employees on single coverage.

Employer A – Sets up an HDHP/HRA/HSA combo, single coverage example

- Employer A implements $3000 deductible HDHP

- Employer A pledges to reimburse up to $1600 through the HRA, after employee satisfies the first $1400 HDHP minimum deductible. Maximum risk to employer $16,000 ($1,600 x 10 = $16,000)

- But the employer’s typical estimated liability is more like 25% since not all employees will meet their full medical plan deductible (a reasonable assumption), meaning employer estimated liability is only $4,000 ($16,000 x 25% = $4,000)

- Potential out-of-pocket deductible liability to employee: $1,400 ($3,000 – $1,600 = $1,300)

Employer B – Wants to only spend the $4,000 that was calculated above as Employer A’s estimated liability, but wants to contribute first-dollars to the employee’s HSA accounts (no HRA included)

- Employer B implements $3000 deductible HDHP

- Employer B contributes $400 to each employee’s HSA account ($4,000/10 employees = $400)

- Potential out-of-pocket deductible liability to employee: $2,600 ($3,000 – $400 = $2,600)

In Example A, the employee’s out-of-pocket liability is much lower and the employer’s bang-for-the-buck is much greater: the HRA/HSA combo has it in spades.

How would it work for families?

Family coverage means the employee must meet the first $2800 of the medical deductible (2020 HDHP minimum for family coverage). The HRA would reimburse the remaining family deductible. The employee would be able to contribute the HSA maximum contribution limit for family coverage ($7100 in 2020) plus an extra $1000 if the employee is age 55 or over.

What’s the catch(es)?

While this is a great option to consider, there are a couple things to keep in mind:

- An HRA is a COBRA eligible benefit. This means that an employee could still be reimbursed for deductible expenses even after they leave the company. However, here at SBA, we calculate a COBRA premium for the HRA so a COBRA-qualifying beneficiary will decide if they want to pay it and be covered or not. In our experience, using the example above, the HRA-COBRA premium would be approximately $40 for single coverage per month.

- Employee education could be challenging. Particularly the use of HSA debit cards could become tricky when employees near $1400 (single) or $2800 (family) in deductible expenses due to potential double-dipping. Anything over those amounts, up to the deductible cap, would be employer paid through the HRA.

- Most business owners are not eligible for HRA reimbursements unless they a C-Corporation. The same ineligible owners cannot contribute to their HSA Accounts with pre-tax dollars but can make post-tax contributions and later take an “above-the-line” tax deduction when filing.

Another potentially brilliant idea

Since we know any client with an HSA is going to need a Premium Only Plan (POP) in order to pre-tax employee HSA contributions, why not consider going all the way with a Flexible Spending Account? Here’s how that might work: A Limited Health FSA will allow employees to put aside money to pay for dental, vision and non-deductible medical expenses. It would allow them to let their HSA bank balances grow while funding those other non-deductible types of expenses using the Health FSA. Go crazy and throw in a Dependent Care Account and the tax savings soar. A Flexible Spending Account already contains the Premium Only Account so no need for a stand-alone POP.

Page 4 of IRS Publication 969 details the various combinations of plans that are available to be combined with an HSA to preserve its eligibility and provide employer and employee benefits.

Oh, the variety of alphabet soup you can make when you work with the masters

There are many possible tools at your disposal when you have an expert partner in the alphabet soup of HSAs, HRAs, FSAs, POPs and COBRA. It’s all in knowing how to combine them to reach maximum cost savings and promote consumer-directed healthcare for participants. Let me know if you want to learn more or if we can provide you with a proposal for an HSA/HRA combo. Our HSA account administration includes investment options plus a patented ClaimsVault for employee self-administration of HSAs.