Common industry knowledge tells you that an employer with more than 20 employees is COBRA eligible. And that means that any of their employees (or qualified beneficiaries) who terminate or trigger another Qualifying Event are due a COBRA Notice. But in reality, the determination is more nuanced than that. In some cases, a Qualifying Event does not, in fact, trigger a COBRA notification. Much like the game of Clue, the purpose of this article is to:

- Who: Is eligible to trigger a Qualifying Event

- When: A Qualifying Event does not trigger a COBRA notification

- What: Qualifying Events do not cause a loss of coverage

Let’s start with what we all know.

Who can trigger a Qualifying Event?

Assuming an employer is eligible for COBRA, there are seven COBRA Qualifying Events that will often (but, as you will see, will not always) cause a loss of coverage in the employer’s group medical, dental, vision, Health Flexible Spending Account (FSA), Health Reimbursement Account (HRA), Telehealth or Employee Assistance Plan (EAP). Note, insurance companies are concerned with the loss of coverage date while COBRA law is concerned about the Qualifying Event trigger date.

The Seven Qualifying Events (length of COBRA eligibility):

- A covered employee who terminates employment (18 months)

- A covered employee who experiences a reduction in hours (18 months)

- The covered dependent of a deceased covered employee (36 months for the covered dependents)

- The ex-spouse of a covered employee (36 months for the ex-spouse)

- A spouse who is legally separated from a covered employee (36 months for the spouse who is not a legal dependent)

- A dependent child who ages out of coverage under the terms of the plan (36 months for the child turning age 26)

- A covered employee who becomes entitled to Medicare (applies only to Retiree plans)

Although on the surface, these Qualifying Events appear very straightforward, there are outlying cases where the “when” and “what” don’t necessarily lead to the necessity of a COBRA notice. Let’s look at some of these cases.

When the employee’s last day is not a trigger date

In the case of termination of employment, the last day worked is often the date that triggers the Qualifying Event, but not always. Here are a few examples:

- No call/no show. Many companies have a no-call, no-show provision in their attendance policy (e.g., three days of no-call, no-show will result in termination), after which an employee is terminated based on job abandonment. In this case, the date of termination, and thus Qualifying Event, is after the third day of no-call, no-show, which does not coincide with the employee’s last day of work.

- Accumulated paid leave. Another example of an extended termination date might be last day worked plus accumulated paid leave. The Qualifying Event is triggered on the last day of accumulated paid leave.

- Completion of investigation. A third example might be an employee who didn’t show up for work and the employer is investigating what happened to the employee (like a hospitalization due to injury or a misconduct investigation). In this case, the Qualifying Event trigger date is when the investigation is completed and the employee is deemed terminated as of that date.

These dates are particularly important to employers who are deemed newly COBRA eligible on January 1st. (Read our article on calculating COBRA eligibility.) In this case, the question becomes what happens to employees with a December prior year termination date? The triggering event happened during a year when the employer was not a COBRA eligible employer. So, even though coverage is lost on January 1st, the triggering event date is the key to determining if a Qualifying Event notice is mailed or not.

When a Qualifying Event does not trigger a loss of coverage

A Qualifying Event usually causes a loss of coverage, but sometimes it doesn’t. Here are some examples:

- Affiliated companies. We have several separate COBRA clients enrolled in the same benefit plans under an affiliated employer group. I’m told an employer can add affiliated companies to their benefit plans if they 1) are in the same industry and 2) have common ownership. The affiliated company(ies) are listed as different divisions under one employer identified as the primary employer. When an employee terminates employment under one employer and goes to work for another employer covered under the same benefits, there is no loss of coverage. The Qualifying Event of Termination of Employment did indeed happen, but there was no loss of coverage therefore no Qualifying Event COBRA notice is required to be mailed.

- Plan termination. Another example of a loss of coverage where no COBRA notice is mailed is plan termination. An employer terminates its group medical plan. All the employees have lost coverage. Plan termination is not one of the seven qualifying events listed at the top of this article.

- Legal separation. A married couple are preparing to divorce and legally separate before the divorce becomes final. Legal separation is a qualifying event but legally separated couples are still considered married to each other for most federal and state-law purposes. The employee may keep the spouse on the group plan with no loss of coverage until the divorce is finalized.

What else triggers a Qualifying Event?

Unless for one of the reasons stated above, a loss of group health plan coverage means “to cease to be covered under the same terms and conditions as in effect immediately before the Qualifying Event.” In this case, the Qualifying Event doesn’t involve termination, death or divorce, rather it is reflective of changes to the plan itself, including:

- An increase in required premiums

- A reduction of benefits

- Any other change in the terms or conditions of coverage

Here’s an example of a reduction of benefits. ABC Company provides an employer-paid medical plan with two types of coverage. Coverage A is a generous package of benefits for employees who are scheduled to work at least 80 hours per month. Coverage B is a less generous benefits package for all other employees. Jim is scheduled to work 100 hours per month and has Coverage A. His hours are reduced to 60 hours per month, which means that he will no longer have Coverage A benefits. Thus, Tom has experienced a loss of coverage due to the Qualifying Event of Reduction of Hours and Benefits. He must be given a COBRA notice and the opportunity to elect COBRA coverage under Coverage A, even though he is entitled to Coverage B medical benefits.

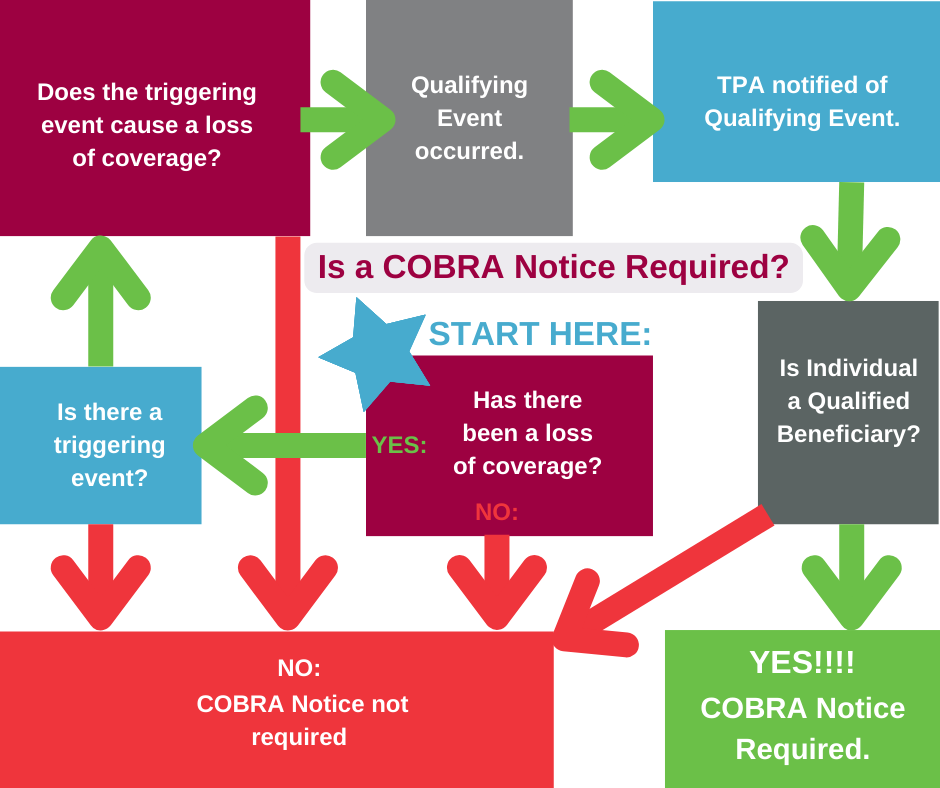

Determining the who, when and what of COBRA eligibility is a bit of a puzzle. This chart can help lead you to the end result: is an employee eligible to receive a COBRA notice?

Unsure if a COBRA notice is required?

As always, if you aren’t sure whether or not either/or, a) your company is COBRA eligible, or b) an employee (or one of their dependents) is eligible to receive a COBRA notice, your first call should be to SBA. We can help you determine the who, when and what that will definitively determine the end result of the case of the COBRA conundrum. We’ll leave it up to you to determine if it was actually Colonel Mustard in the Kitchen with the Candlestick.