The first thing you must know about my bias for this article is that I’m an old bookkeeper. As an old bookkeeper, I like an expense with a hard end date. I want to book gains and losses on a certain date and move on. I don’t like outstanding liabilities that may be paid far in the future.

When first enacted a Flexible Spending Account (FSA) plan was a simple twelve-month plan with a run-out period to submit claims incurred during the plan year, our run-out periods are always sixty days. Some plans still function this way today. Simple, clean, book the gain or loss and move on.

The beef, however, with the early FSA was the “use it or lose it” requirement. In fact, a certain congressman’s wife was so frustrated with losing money in her Health FSA, Congress came up with the Extended Grace Period provision. This gave participants an extra 2.5 months to spend down an unused balance. In my opinion, a reasonable amount of time and, for the bookkeeper in me, a hard date and then we close the books.

But, in 2013 Congress passed another option, the Carryover provision. This allowed participants unlimited time to spend down an unused balance of $500 or less, essentially into infinity and beyond – giving this bookkeeper heartburn.

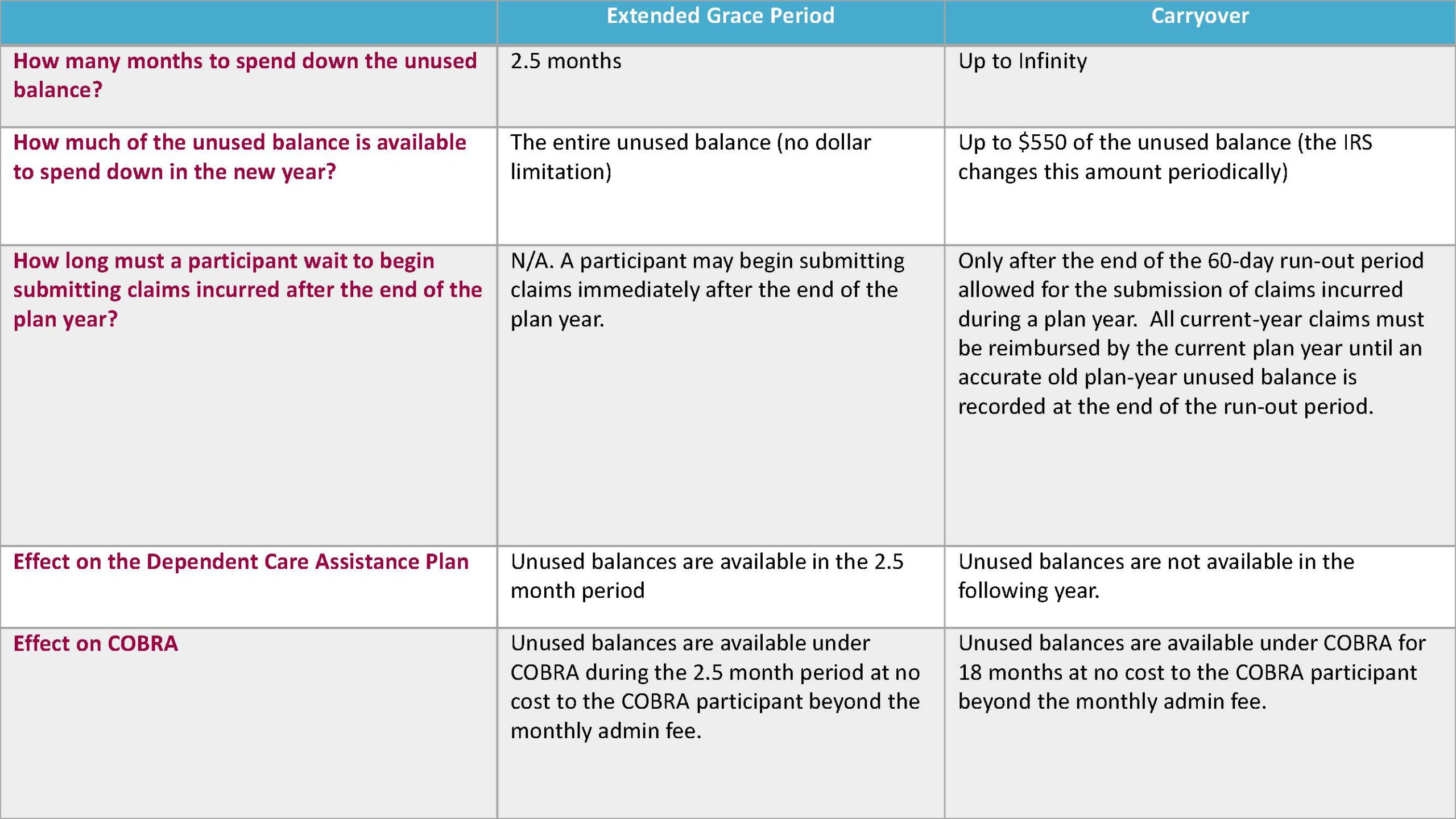

How do the 2 provisions compare?

The table below illustrates some of the differences between the optional Extended Grace Period and Carryover provisions that can be added to a Flexible Spending Account plan:

If you must Carryover…

While my preference is for the cleaner, more defined Grace Period provision, there are clients who opt for the Carryover option, the primary reason given is that with the Carryover, the employee has a longer period of time to use (at least up to $550) of their unused balance. For those clients, we do encourage them to consider one of two options to limit the time to spend down an unused balance and mitigate uncertainty.

-

- Limit time to use balance to twelve months and/or

- Require enrollment in the following plan year in order to access unused funds from the prior year.

It pains me to see a client pay our monthly fee for a participant to carry forward a balance of $46.92 for several consecutive years. You’d be surprised at how many participants have miniscule balances rolling over. In our experience, even with quarterly account reminders, procrastination is a nearly universal human trait.

Alphabet soup considerations

Setting aside my bookkeeper hat and putting on my alphabet soup hat, let’s address the Health FSA and COBRA. It’s already a tricky COBRA premium calculation when a participant terminates in the middle of a plan year, but what if the plan year finished, a carryover is made available in the next year and someone terminates employment? The Health FSA was fully funded in the prior plan year so no COBRA premium can be charged. The funds need to be available to the terminated participant in the same way they would be made available to an active employee. Luckily, due to COBRA, there is a hard end date to this liability, 18 months from termination of employment. But even with that, the Grace Period provision, again, makes this much cleaner as there is only 2.5 months of COBRA liability obligation.

Just say Grace

My final argument in favor of the Extended Grace Period is that employee education is more challenging with the Carryover provision. With the Carryover, the unused balance is not credited to the employee’s account until the end of the run-out period so we can give the participant plenty of time to submit all prior year claims to the plan. It is only then that we know what the unused amount is and carry it forward to the new plan year. This confuses many employees. The Extended Grace Period is, yet again, much more straightforward.

So, I’ve explained my bias. I’ve laid out the details. I know many of you are going to pick the Carryover option because you don’t want anyone to lose money in the Health FSA plan. I applaud your dedication to your employees. I’m just glad I’m not your bookkeeper!